UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

| | | |

| Filed by the Registrant [X] | |

| Filed by a Party other than the Registrant [ ] |

| Check the appropriate box: |

| [ ] Preliminary Proxy Statement | |

| [ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| [X] Definitive Proxy Statement | |

| [ ] Definitive Additional Materials | |

| [ ] Soliciting Material under §240.14a-12 | |

| | | | | | | | | | | | |

| MGIC Investment Corporation |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| [X] | No fee required |

| [ ] | Fee paid previously with preliminary materials |

| [ ] | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

MGIC Investment Corporation

Notice of 2022 Annual Meeting of Shareholders

| | | | | |

| | | | | | | | | | | | | | | | | MGIC Investment Corporation |

| Notice of 2024 Annual Meeting of Shareholders |

| | | | | | | | | | | | | | |

| | When:Meeting Date & Time

Thursday,

April 28, 2022, at 25, 2024 9:00 a.m. Central time. Time | | | Via Webcast

www.virtualshareholdermeeting.com/MTG2024 Admittance to the webcast begins at 8:45 a.m. Where:

|

To MGIC Investment Corporation Shareholders:

At our 2024 Annual Shareholders’ Meeting, you will be asked to vote upon the following proposals:

Via webcast at www.virtualshareholdermeeting.

com/MTG2022

| | | | | |

| |

Items of Business:Business | |

| Proposal 1 | Election of thirteen directors |

| Proposal 2 | Advisory vote to approve named executive officer compensation |

| Proposal 3 | Ratification of appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 20222024 |

| Proposal 4 | Any other matters that properly come before the meetingRecord Date:

You can vote if you were a shareholder of record on March 11, 2022.

| |

| | | | |

| | | | | meeting. |

Your vote is very important. Whether or not you plan to attend our Annual Meeting, we encourage you to read our proxy materials and to vote as soon as possible using one of the methods described beginning on page 6075.

| | |

| By Order of the Board of Directors, |

|

| Paula C. Maggio |

| Executive Vice President, General Counsel and Secretary |

March 25, 202222, 2024 |

| | | | | | | | |

OUR | PROXY STATEMENT AND 20212023 ANNUAL REPORT TO SHAREHOLDERS ARE AVAILABLE AT HTTPS://MATERIALS.PROXYVOTE.COM/552848.552848 |

Table of Contents

| | | | | |

| Item 2 – Advisory Vote to Approve Our Executive Compensation (Continued) | |

| |

| |

| |

| |

20212023 Grants of Plan-Based Awards | |

Outstanding Equity Awards at 20212023 Fiscal Year-End | |

| 2023 Stock Vested | |

| |

| |

| |

| |

20212023 CEO Pay Ratio | |

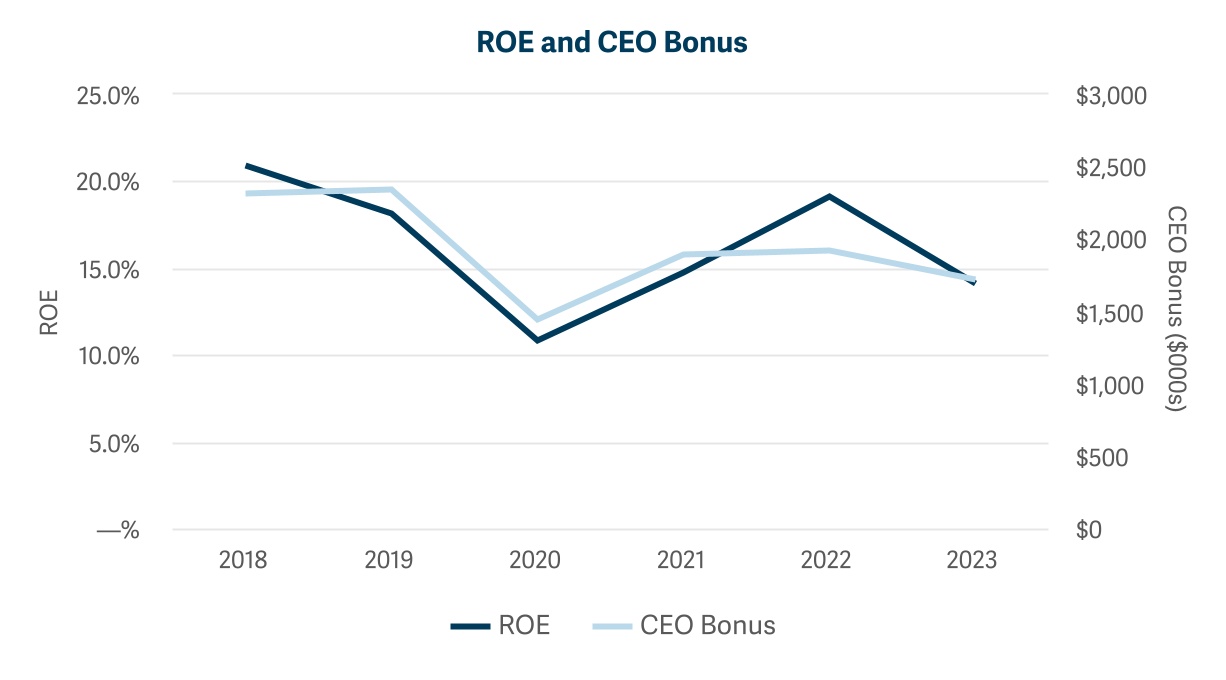

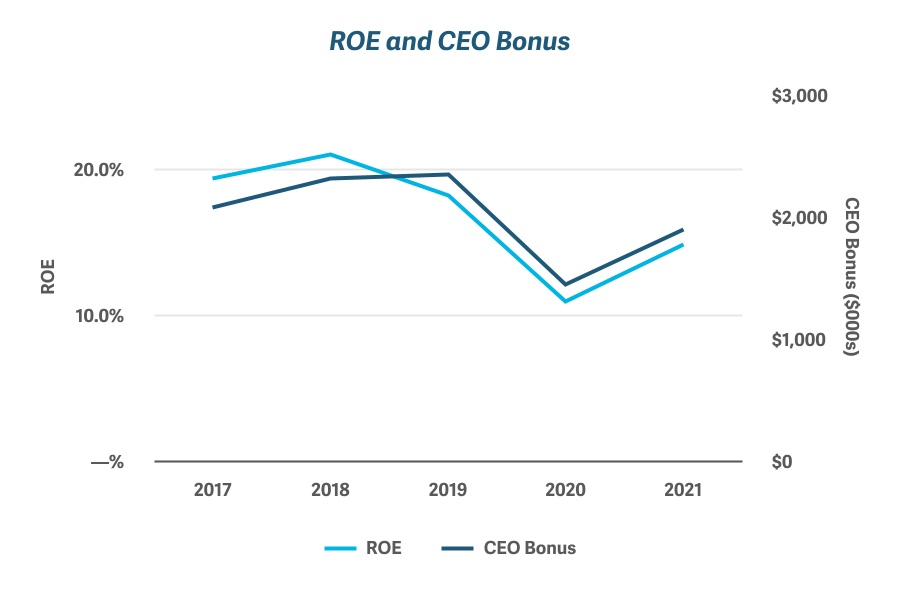

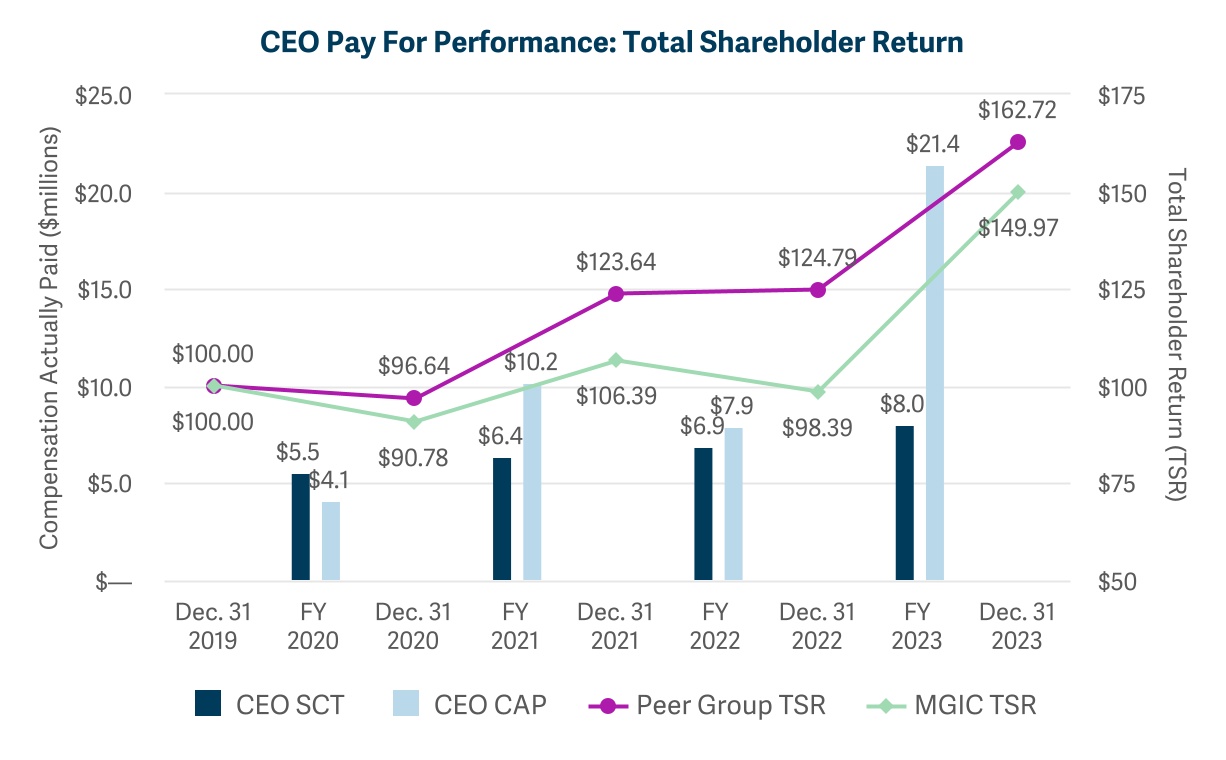

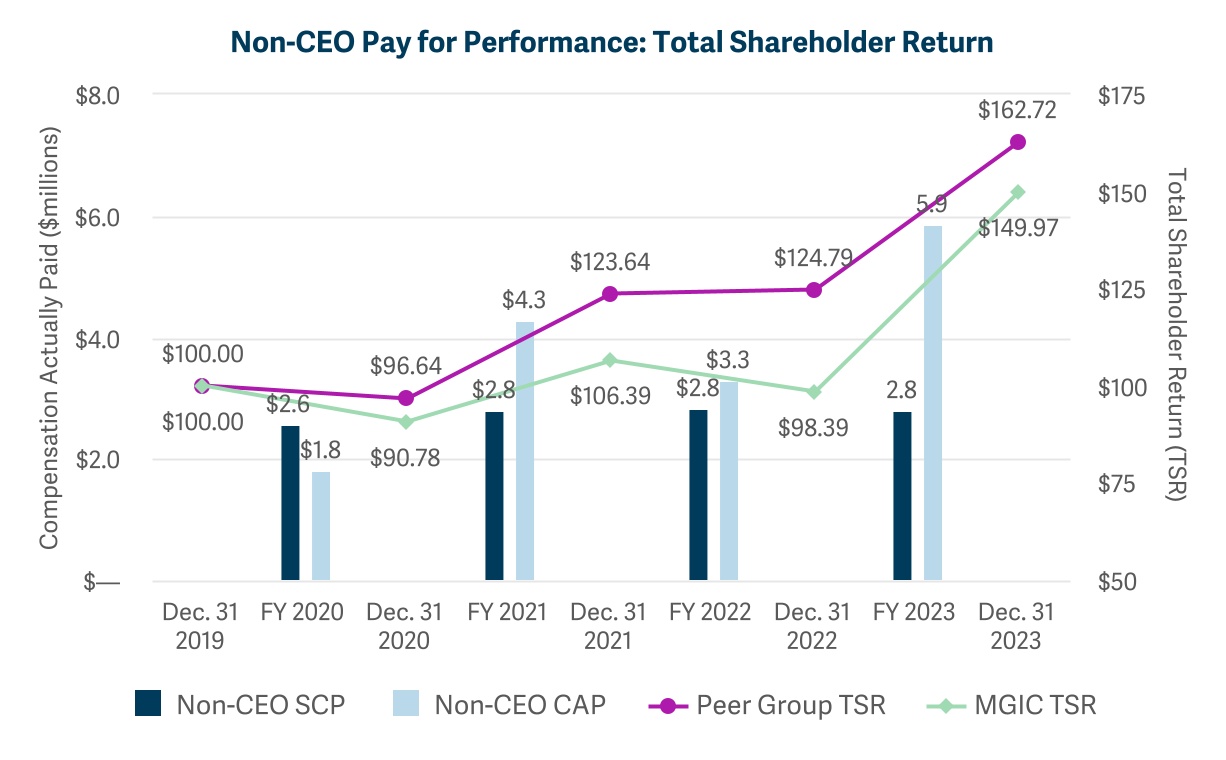

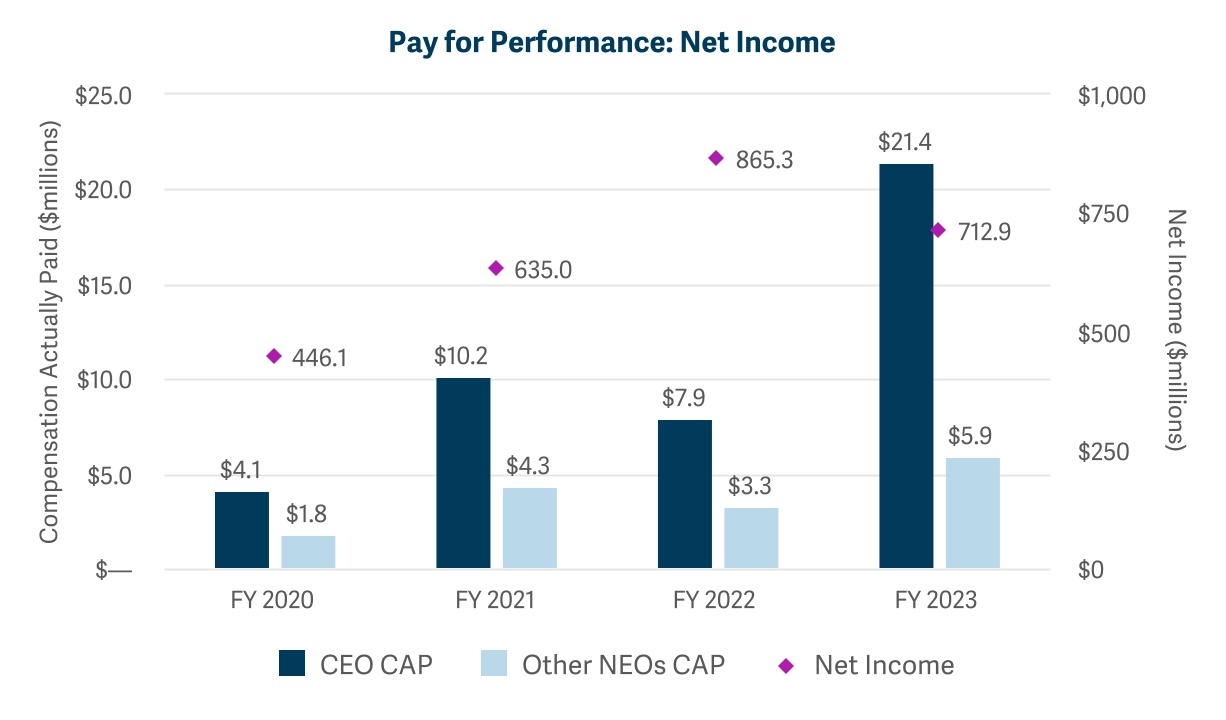

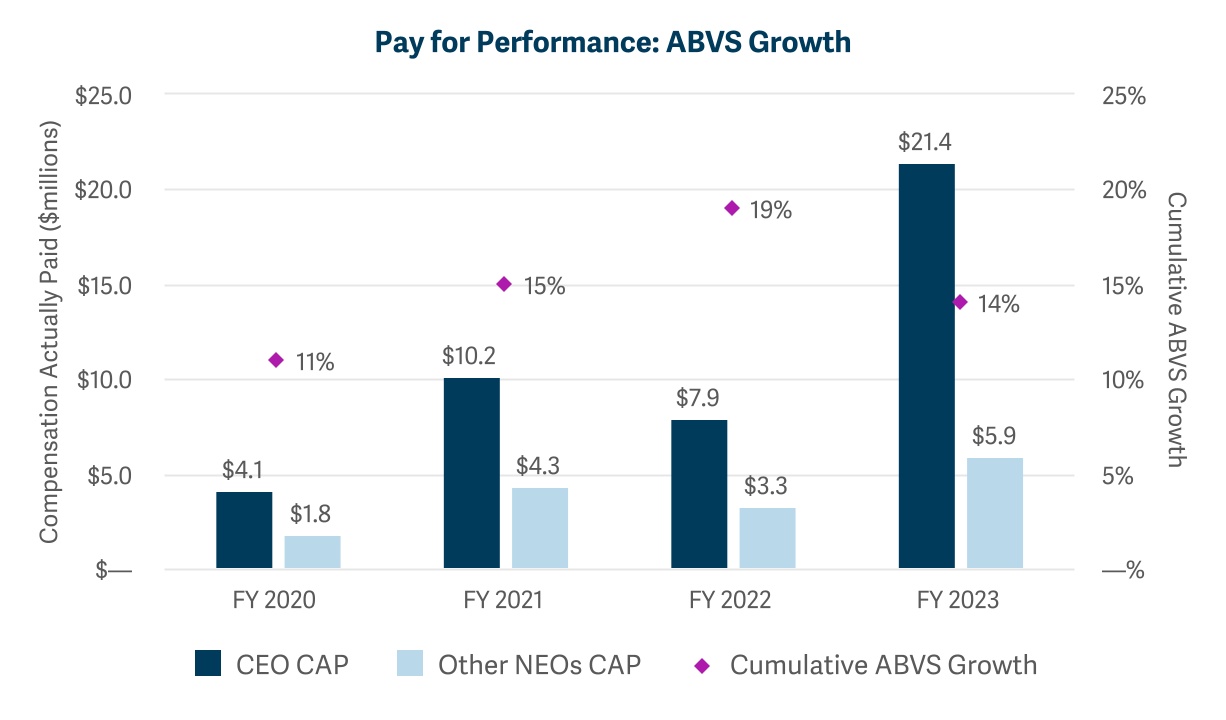

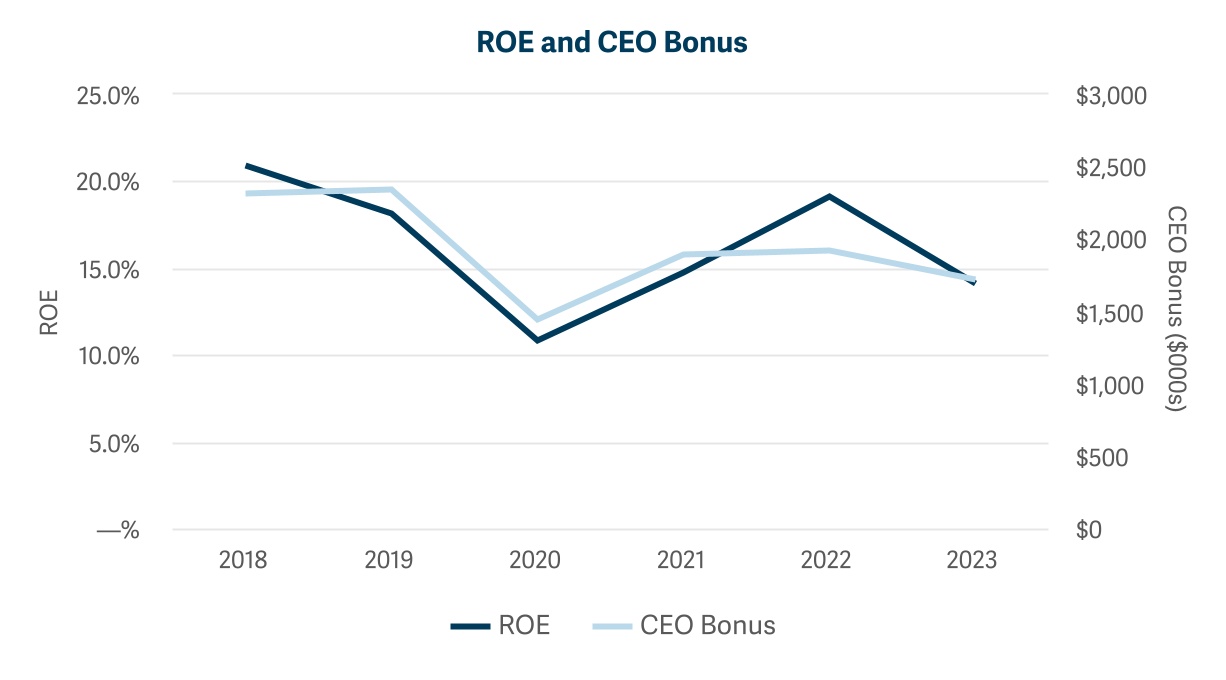

| 2023 Pay for Performance | |

| | | | | |

| Item 3 – Ratification of Appointment of Independent Registered Public Accounting Firm | |

| |

| |

| Stock Ownership | |

| About the Meeting and Proxy Materials | |

| Appendix A – Glossary of Terms and Acronyms | App

|

| Appendix B – Explanation and Reconciliation of Non-GAAP Financial Measures | App |

| | | | | |

| MGIC Investment Corporation

P.O. Box 488

MGIC Plaza, 270 East Kilbourn Avenue

Milwaukee, WI 53201 |

Proxy Statement

Our Board of Directors is soliciting proxies for the Annual Meeting of Shareholders to be held Thursday, April 28, 202225, 2024 at 9:00 a.m. Central time, via webcast at www.virtualshareholdermeeting.com/MTG2022,MTG2024, and at any postponement or adjournment of the meeting. In this Proxy Statement we sometimes refer to MGIC Investment Corporation as “the Company,” “we” or “us.” This Proxy Statement and the enclosed form of proxy are being mailed to shareholders beginning on March 25, 2022.22, 2024. If you have any questions about attending our Annual Meeting, you can call Investor Relations at (414) 347-6596.347-2635.

Proxy Summary

This summary highlights information contained elsewhere in our Proxy Statement and does not contain all of the information you should consider. Please review the Company’s complete Proxy Statement before voting. Please refer to our Glossary of Terms and Acronyms in Appendix A to this Proxy Statement for definitions of certain capitalized terms. Voting Matters and Board Recommendation

| | | | | | | | | | | |

| Proposal | Voting Matter | More Information | Board Vote Recommendation |

| 1 | Election of Thirteen Directors | | FOR each Director Nominee |

| 2 | Advisory Vote on Executive Compensation | | FOR |

| 3 | Ratification of Independent Registered Public Accounting Firm | | FOR |

MGIC Investment Corporation – 2024 Proxy Statement │ 1

Our Business Strategies and 20212023 Highlights

Through our subsidiary, Mortgage Guaranty Insurance Corporation (MGIC), we are a leading provider of mortgage insurance to lenders throughout the United States and to Fannie Mae and Freddie Mac (the GSEs). Our business strategies are to 1) maximize the value we create through our mortgage credit enhancement activities; 2) differentiate ourselves through our customer experience; 3) establish a competitive advantage through our digital and analytical capabilities; 4) excel at acquiring, managing and distributing mortgage credit risk and the related capital; 5) maintain financial strength through economic cycles; and 6) foster an environment that embraces diversity and best positions our people to succeed. As we discuss in the Compensation Discussion & Analysis (CD&A), the compensation of our Named Executive Officers (NEOs) is tied to our financial performance and to performance against business objectives that directly support these business strategies.

MGIC Investment Corporation – As we began 2023, the volume of mortgage originations was predicted to be 22% lower than in 2022, Proxy Statement │ 1

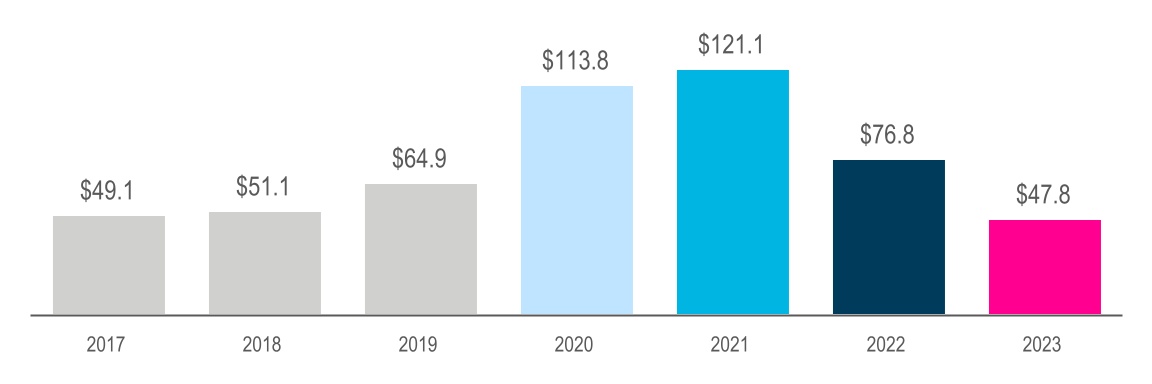

We began 2021 with continuedand 59% lower as compared to 2021. Additionally, there was uncertainty about how COVID-19 would impact the borrowers whose mortgages we insuredmortgage rates and the size of the market for our product. Unemployment was still a high 6.7% at year-end 2020. Mortgage originationsaffordability challenges were expected to be 20% lowertemper homebuyer demand. Despite these headwinds, we demonstrated strong performance, including against performance measures that are considered in 2021 than in 2020determining the annual bonus and the marketlong-term equity compensation of our NEOs.

Net income for our product2023 was expected to shrink by 17%. There was some concern about home prices after they had increased by 11.7% in 2020 (seasonally-adjusted Purchase-Only U.S. Home Price Index of the FHFA).

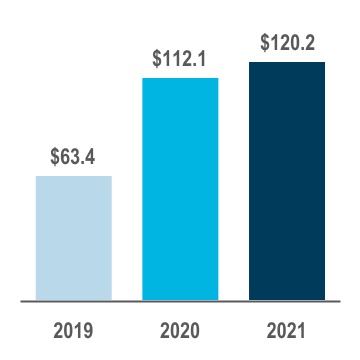

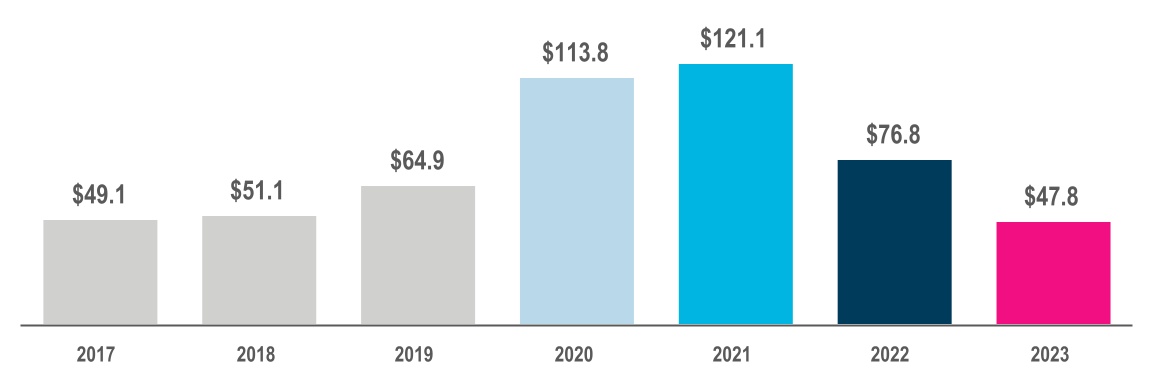

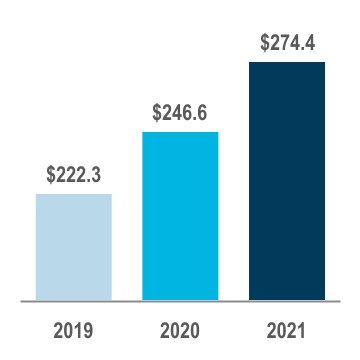

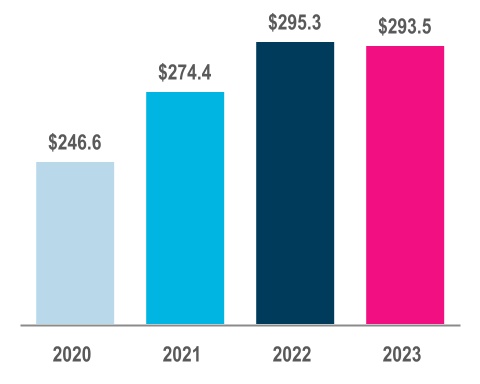

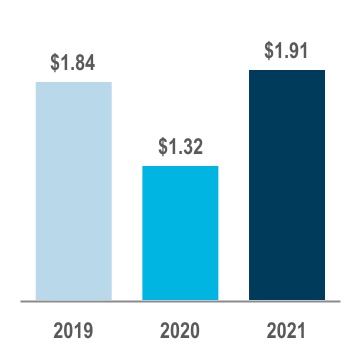

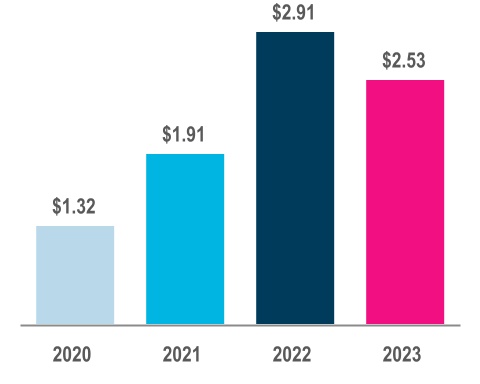

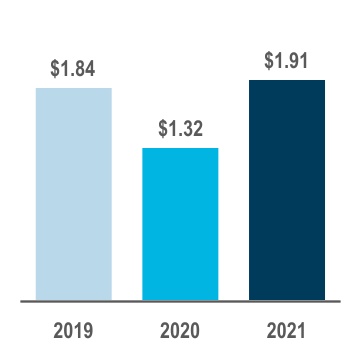

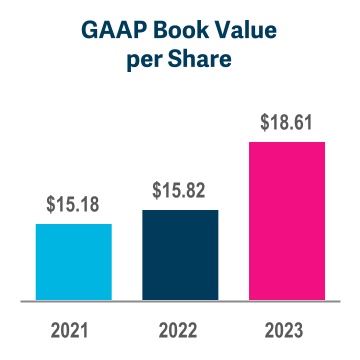

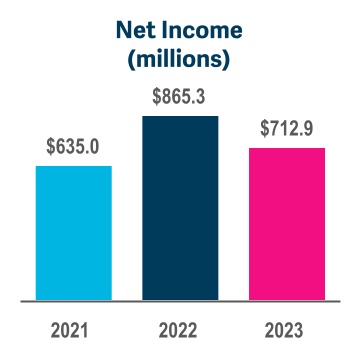

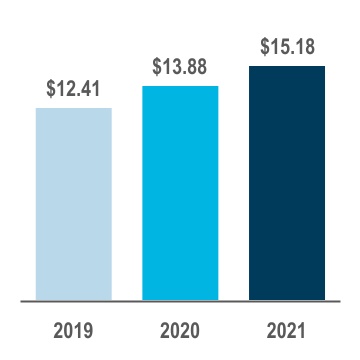

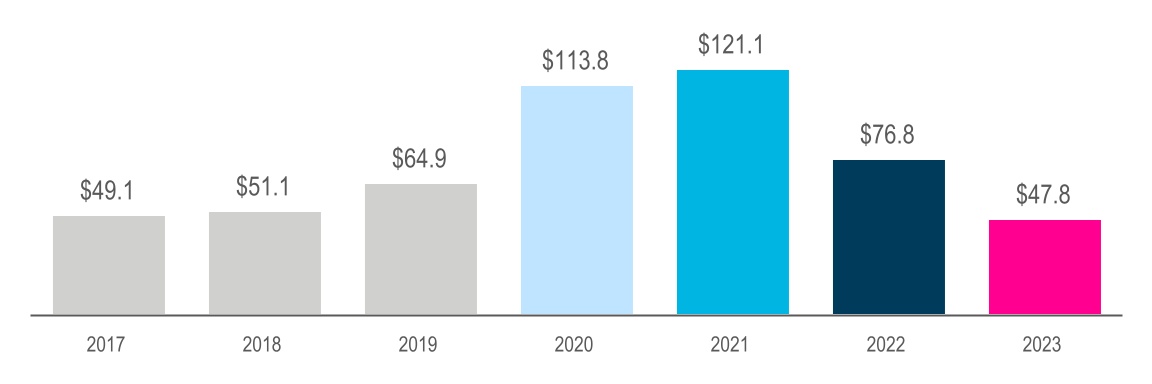

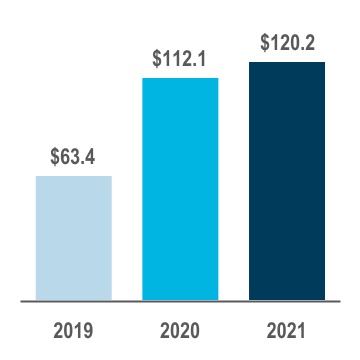

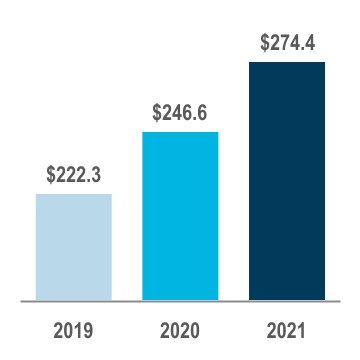

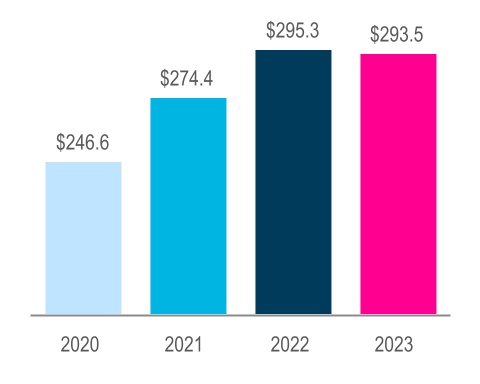

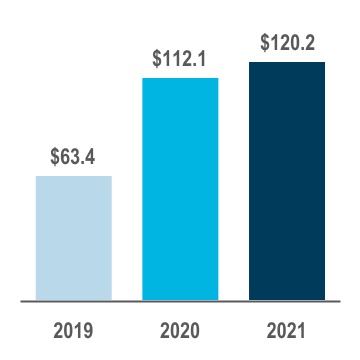

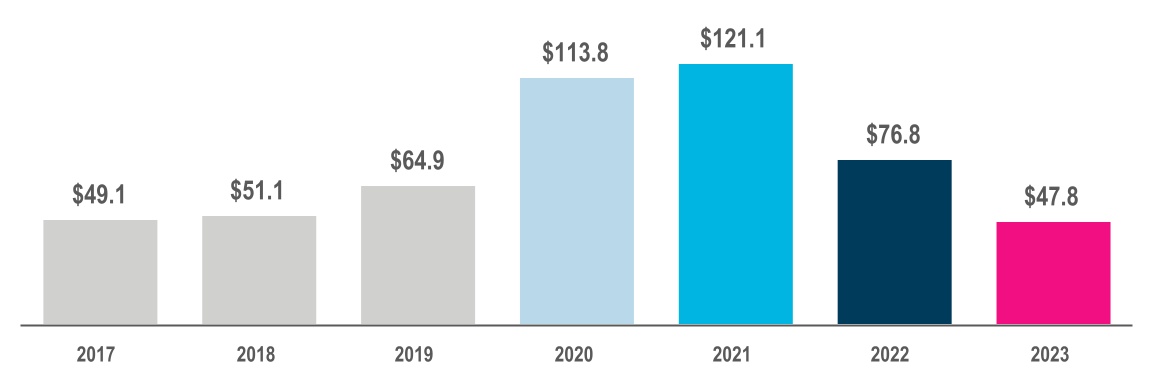

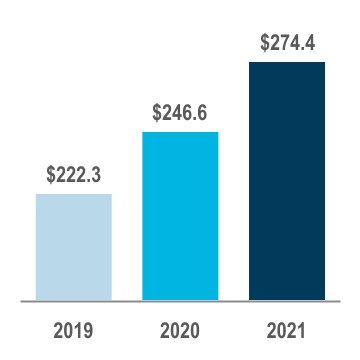

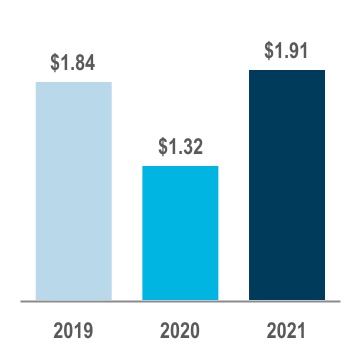

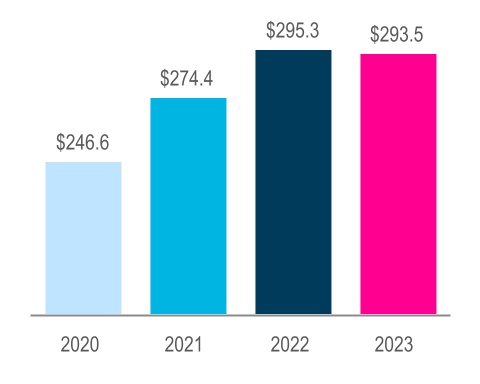

Despite those potential headwinds, our Company performed very well in 2021: we earned net income of $635$712.9 million on revenues of $1.2 billion. As shown by the metrics below, in 2021,In 2023, our new insurance written grew by 7.2%,was $47.8 billion, reflective of our performance and the smaller mortgage origination market size. While our 2023 NIW is lower than the most recent three years of record results, as shown below it is comparable to the more normalized levels seen before the onset of the COVID-19 pandemic. Our insurance in force grew by 11.3% and ourat the end of 2023 was $293.5 billion, just short of the all-time high of $295.3 billion that we reached in 2022. Our adjusted net operating income per diluted share grew by 44.7%.was $2.53 in 2023. These metrics, among others, were considered when determining the 20212023 bonuses of our NEOs and our success in advancing our business strategies.

2 │ MGIC Investment Corporation – 2024Proxy Statement

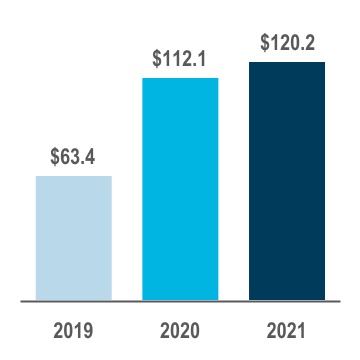

New Insurance Written (NIW)

(billions)1

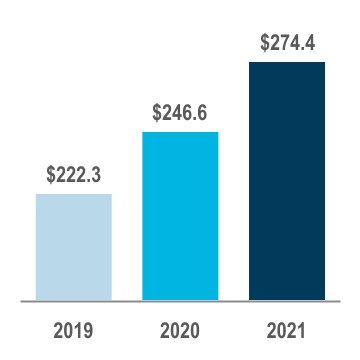

Insurance in Force (IIF)

(billions)2

Adjusted Net Operating Income per Diluted Share3

| | | | | |

| 1 | | | | | For purposes of the bonus plan, NIW includes (i) traditional loan level insurance, (ii) loan level insurance executed through a managing agent or directly with a GSE or other entity, and (iii) credit risk transfer (calculated as 1/3 of the unpaid principal balance of the loans committed to be insured by us during the year). NIW received credit for bonus purposes only if its expected risk-adjusted return on capital exceeded the Company's hurdle rate. Because the NIW for the bonus plan includes a more comprehensive definition of NIW when compared to the primary NIW disclosed for financial reporting purposes, NIW figures shown in our financial reporting differ slightly from what is shown in this Proxy Statement. |

12 | Direct NIW (beforeFor purposes of the effectsbonus plan, IIF is the unpaid principal balance, as reported to us, of reinsurance).the loans insured by us, as of the end of the year, adjusted for financial impacts of GSE-mandated mortgage insurance cancellations inconsistent with prior business practices. |

2 | Direct primary IIF (before the effects of reinsurance), which is an important driver of our future premiums. |

| 3 | This is a non-GAAP measure of performance. For a description of how we calculate this measure and for a reconciliation of this measure to its nearest comparable GAAP measure, see Appendix B to this Proxy Statement. |

MGIC Investment Corporation – 2024 Proxy Statement │ 3

Following are several of our additional 20212023 accomplishments that furthered our business strategies.

| | | | | | | | |

| Business Strategy | | | | | | | | Results |

Business Strategy | | Results |

| Maximize value created through mortgage credit enhancement activities | è | Increased book value per common share by 18%. Earned $635$712.9 million of net income on $1.2 billion of revenues, compared to $446 million in 2020.revenues. Earned a 13.5%15.4% return on beginning shareholders' equity. Increased book value per common share by 9.4%.

|

| Differentiate through customer experience | è | Our sales team is a coreModernized and sustainable strength - it is a brand built over decades.

Improvementsdifferentiated the value we provide to our systems and processes have ledcustomers by making it easier to more efficient underwriting for our customers.do business with MGIC.

Our market share is evidence of the valueOngoing evolution of our business development functions in order to adjust to changing buying behaviors in the marketplace. MGIC's consultative sales approach remains a differentiator.

Continued to make investments to maintain and enhance our customer experience.experience advantage. |

| Establish competitive advantage through digital and analytical capabilities | è | We continuedEstablished an Enterprise Project Management Office to prioritize and monitor the progress of our technological initiatives and investments.

Enhanced our risk-based pricing tool, MiQ, to better compete in an increasingly dynamic market. Continued to transform our business processes along a number of dimensions, including: •Pricing

•Dataincluding data and analytics, modeling, and data management.

•Inside sales

•Underwriting

|

2 │ MGIC Investment Corporation – 2022 Proxy Statement

| | | | | | | | |

Business Strategy | | Results |

| Excel at acquiring, managing and distributing mortgage credit risk and related capital | è | Expanded our reinsurance program by: •Reaching favorable terms to secureSecuring quota share reinsurance coverage on NIWcovering the majority of our 2024 NIW. •Entering into a $330 million excess of loss reinsurance agreement executed through 2023. •Executing twoan insurance linked note transactions,transaction.

•Placing a forward-commitment excess of loss reinsurance agreement providing a total of $797$97 million in excess-of-loss reinsurance coverage on a portion of our 2020 and 2021limit covering 2023 NIW. These transactions allowed us to better manage our risk profile and provided a source of capital relief. |

4 │ MGIC Investment Corporation – 2024Proxy Statement

| | | | | | | | |

| Business Strategy | | Results |

| Maintain financial strength through economic cycles | è | S&P upgraded MGIC's long-term financial strength rating to A- and the long-term Issuer Credit Rating of MGIC Investment Corporation was upgraded to BBB-. AM Best revised the outlook for MGIC's financial strength rating from stable to positive. Maintained financial strength and capital flexibility while returning approximately $385 million in capital to shareholders: •Repurchased 5.6%paying shareholder dividends of our shares outstanding at$0.43 per share for the beginning of the year.

•Increased our cash dividend by 33% in the second half of 2021.year, a 19% increase from 2022.

Repurchased $9921.7 million par value of outstanding shares. Fully retired our outstanding 9% Junior Convertible Debentures, which eliminated approximately 7.51.6 million potentially dilutive shares. Our debt-to-capital ratio was below 20% at year-end 2021.

Our capital is well in excess of the requirements of the GSEs and state regulators. |

| Foster an environment that embraces diversity and best positions people to succeed | è | Continued to provide a competitive package of benefits that recognize the unique needs of our workforce and their families. Invested in developmentHeld quarterly town hall meetings focusing on collaboration, planning, prioritization and career growth, implementing targeted tools and trainings to hone the skill sets most critical to the future of work.transparency through open dialogue. Offered co-workers paid time off for volunteering.

Expanded our diversity, equity and inclusion ("DEI") work: •CreatedLaunched a dedicated Community Grant Program to award community grants to non-profit organizations nominated by co-workers. •Produced a customer-facing webinar series to discuss and Inclusion Advisor role.provide DEI resources relevant to the mortgage industry. •Established a relationship with a coalition of education partners helping limited-income, high potential students to graduate from college. •Signed the CEO Action Pledge for Diversity and Inclusion.Hosted small group DEI dialogue sessions as well as quarterly workshops that focused on equitable homeownership.

|

COVID-19 Response and Workplace Evolution

The health and safety of our co-workers is very important to us, as is providing them with the resources and support they need to perform effectively. Our leadership regularly communicates with co-workers, and we have deployed new methods since the onset of COVID-19, including a new MGIC intranet, to support an even more connected co-worker experience. Leadership and co-workers at all levels have found value in the workplace flexibility initiated by COVID-19, so we have adopted a hybrid work model as our new way of operating. Accordingly, we have invested significant time and resources on planning, training, and updating our technology to prepare our teams to work together in a new way, while attempting to maintain equity, productivity and support, regardless of where work is performed.

MGIC Investment Corporation – 20222024 Proxy Statement │ 35

Board Nominees

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | Age1 | Director Since | Primary Occupation | Independent | Committee Memberships2 |

| Analisa M. Allen | 62 | 2020 | Consultant with Gerson Lehrman Group; Former CIO of Data & Analytics and CIO for Home Lending Technology of JP Morgan Chase's consumer bank | Yes | • BT&T • Risk Management |

| Daniel A. Arrigoni | 71 | 2013 | Former President and CEO

of U.S. Bank Home Mortgage Corp. | Yes | • Audit

• Risk Management |

| C. Edward Chaplin | 65 | 2014 | Former President and CFO of MBIA Inc. | Yes | • Risk Management • Securities Inv. |

| Curt S. Culver | 69 | 1999 | Chairman of the Board and former CEO of MGIC Investment Corp. | No | • Executive |

| Jay C. Hartzell ▲ | 52 | 2019 | President of the University of Texas at Austin | Yes | • Audit

• Risk Management |

| Timothy A. Holt | 68 | 2012 | Former SVP and Chief Investment Officer of Aetna, Inc. | Yes | • MDNG • Securities Inv. (C) |

| Jodeen A. Kozlak | 58 | 2018 | Founder and CEO of Kozlak Capital Partners, LLC; Former Global SVP of Human Resources of Alibaba Group | Yes | • BT&T (C) • MDNG |

| Michael E. Lehman | 71 | 2001 | Lead Independent Director of MGIC Investment Corp; Former EVP and CFO of Sun Microsystems, Inc. | Yes | • BT&T • Executive • MDNG * (C) |

| Teresita M. Lowman | 57 | New Nominee | Strategic Advisor to Launch Factory; Former VP of DXC Technology Company | Yes | • Proposed to be on BB&T |

| Timothy J. Mattke | 46 | 2019 | CEO of MGIC Investment Corp. | No | • Executive (C) |

| Gary A. Poliner | 68 | 2013 | Former President of The Northwestern Mutual Life Insurance Company | Yes | • Audit (C) • Risk Management • Securities Inv. |

| Sheryl L. Sculley ▲ | 69 | 2019 | Consultant with Strategic Partnerships, Inc.; Adjunct Professor at the University of Texas at Austin; Former City Manager of the City of San Antonio, Texas | Yes | • Audit • Securities Inv. |

| Mark M. Zandi | 62 | 2010 | Chief Economist of Moody's

Analytics, Inc. | Yes | • Risk Management (C) |

| 1 | | As of March 11, 2022 |

| 2 | | BT&T = Business Transformation and Technology; MDNG = Management Development, Nominating and Governance |

| ▲ | = | Audit Committee Financial Expert |

| C | = | Committee Chair |

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | Age1 | Director Since | Primary Occupation | Independent | Committee Memberships2 |

| Analisa M. Allen | 65 | 2020 | Consultant with Gerson Lehrman Group; Former CIO of Data & Analytics and CIO for Home Lending Technology of JP Morgan Chase's consumer bank | Yes | • BT&T • Risk Management |

| Daniel A. Arrigoni | 73 | 2013 | Former President and CEO

of U.S. Bank Home Mortgage Corp. | Yes | • MDNG • Risk Management |

| C. Edward Chaplin ▲ | 67 | 2014 | Former President and CFO of MBIA Inc. | Yes | • Audit (C) • Securities Inv. |

| Curt S. Culver | 71 | 1999 | Chairman of the Board and former CEO of MGIC Investment Corp. | No | • Executive |

| Jay C. Hartzell ▲ | 54 | 2019 | President of the University of Texas at Austin | Yes | • Audit

• Risk Management |

| Timothy A. Holt | 71 | 2012 | Former SVP and Chief Investment Officer of Aetna, Inc. | Yes | • MDNG • Securities Inv. (C) |

| Jodeen A. Kozlak | 60 | 2018 | Founder and CEO of Kozlak Capital Partners, LLC; Former Global SVP of Human Resources of Alibaba Group | Yes | • BT&T (C) • MDNG |

| Michael E. Lehman | 73 | 2001 | Lead Independent Director of MGIC Investment Corp; Former EVP and CFO of Sun Microsystems, Inc. | Yes | • BT&T • Executive • MDNG (C) |

Teresita M. Lowman ▲ | 59 | 2022 | Strategic Advisor to Launch Factory; Former VP of DXC Technology Company | Yes | • Audit • BT&T |

| Timothy J. Mattke | 48 | 2019 | CEO of MGIC Investment Corp. | No | • Executive (C) |

| Sheryl L. Sculley ▲ | 71 | 2019 | Consultant with Strategic Partnerships, Inc.; Adjunct Professor at the University of Texas at Austin; Former City Manager of the City of San Antonio, Texas | Yes | • Audit • Securities Inv. |

| Michael L. Thompson | 68 | 2023 | President and CEO of Fair Oaks Foods | Yes | • Risk Management |

| Mark M. Zandi | 64 | 2010 | Chief Economist of Moody's

Analytics, Inc. | Yes | • Risk Management (C) • Securities Inv. |

| | | | | | | |

| 1 | | As of March 22, 2024 |

| 2 | | BT&T = Business Transformation and Technology; MDNG = Management Development, Nominating and Governance |

| ▲ | = | Audit Committee Financial Expert |

| C | = | Committee Chair |

46 │ MGIC Investment Corporation – 2022 2024Proxy Statement

Environmental, Social and GovernanceCorporate Sustainability Highlights

As pioneers ofthe company that pioneered the modern form of private mortgage insurance, 65 years ago, MGIC has helped millionswe understand the value of homeownership and its ability to open the door to many economic and social benefits. We help families achieveaccess sustainable homeownership sooner. Thissooner, helping set themselves and the next generation on more stable financial footing, which in turn contributes to more secure and resilient communities.

Our part in the larger whole is a touchstonenot lost on us, and it informs how we come back to when we think aboutapproach the work we do how we do it,both inside and why we do it. Homeownership can be a powerful vehicle for financial stability and generational wealth, which meansoutside our walls. We recognize that our impact –success is inextricably linked to the success of our stakeholders, from our employees and customers, to our investors and our responsibility – extends well beyondboard, to homebuyers themselves, to the walls of our company, beyond our investors, beyond our customers, even beyond the consumers who use our product. Ourwider community and environment within which we work supports resilient communities and the social fabric at large.

Keeping this holistic picture in mind is critical to doing well by each of the audiences to whomgive back. As an organization we are accountable.stronger, healthier, and more resilient when we approach each challenge with an eye toward longer-term solutions with mutual benefit and return.

It’s through that holistic lens that we approach corporate sustainability, harnessing day to day opportunities and activities to further our larger, collective, long-term goals. Our initiativessustainability efforts benefit greatly from our highly-engagedhighly engaged Board of Directors, who provide essential vision and oversight, in partnership with the members of our Environmental, Social and Governance (ESG) ExecutiveCorporate Sustainability Council, who advance these efforts at the management level, cascading our priorities down through each functional areasarea of our business.

In our Environmental, Social and GovernanceCorporate Sustainability Report, published on our website, you can see how our commitment bears out across the work we do, from our internal approach to human capital to our external considerations for environmental and social impact, including, most notably, our efforts in the affordableequitable housing space. We are not including the information contained in that report as a part of, or incorporating it by reference into, this Proxy Statement.

Compensation Highlights

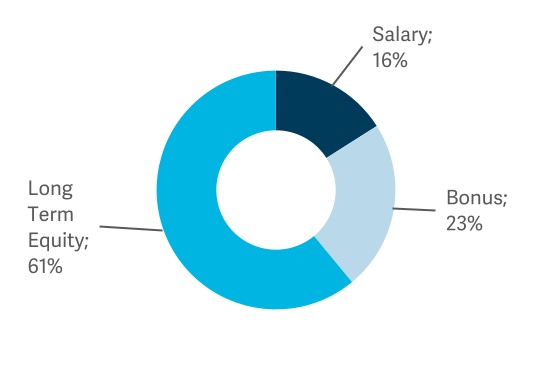

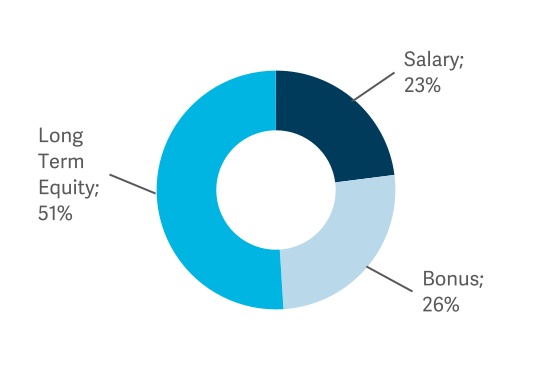

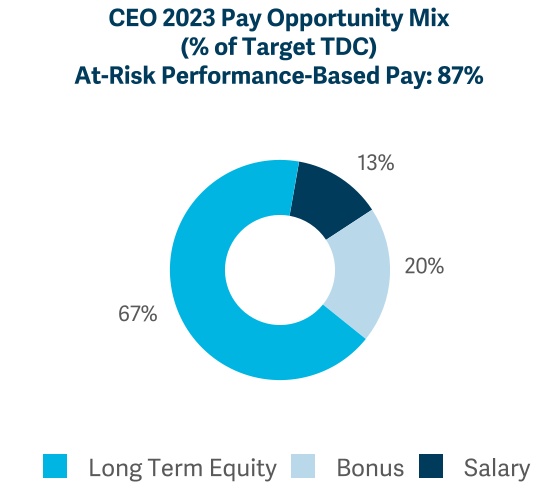

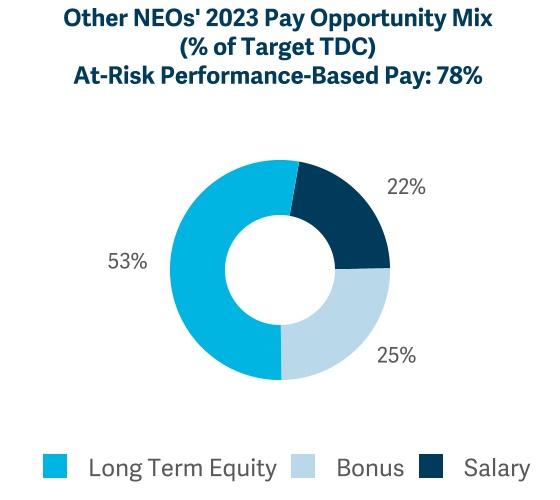

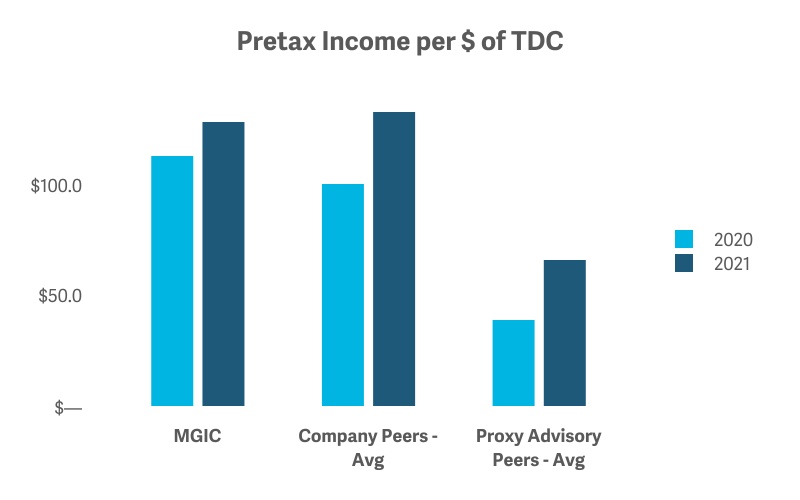

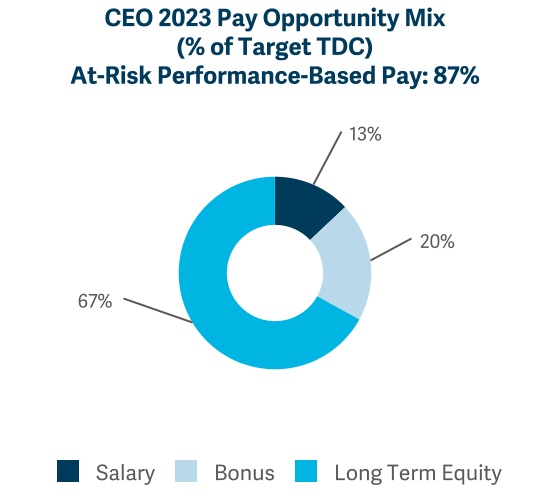

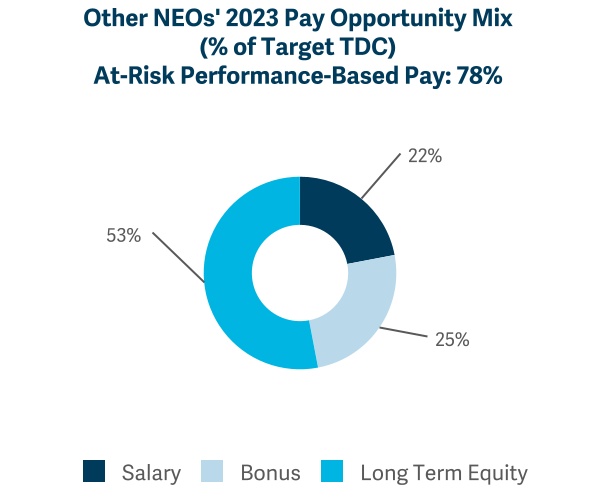

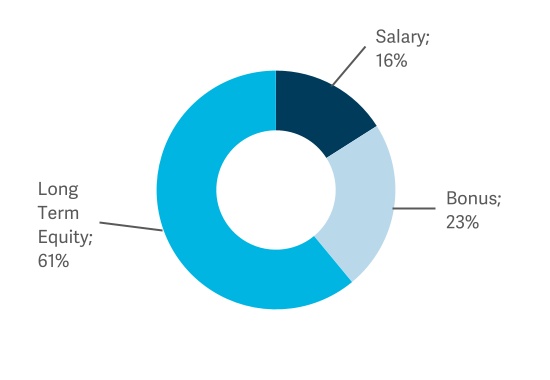

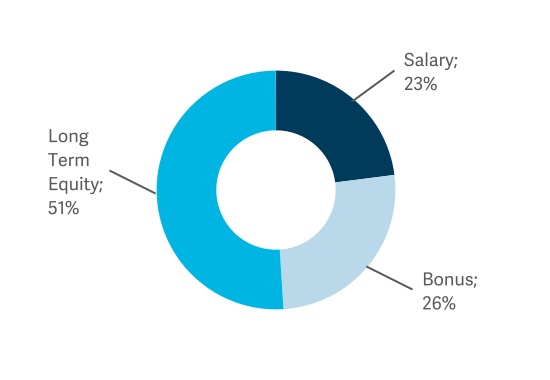

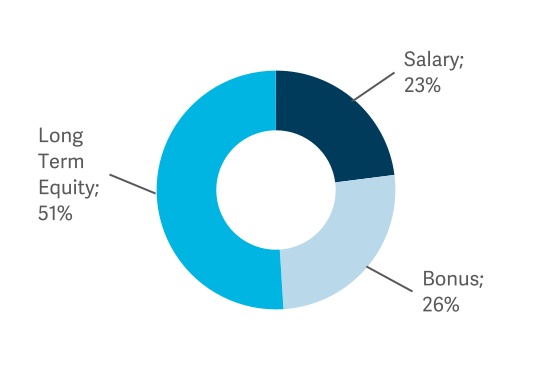

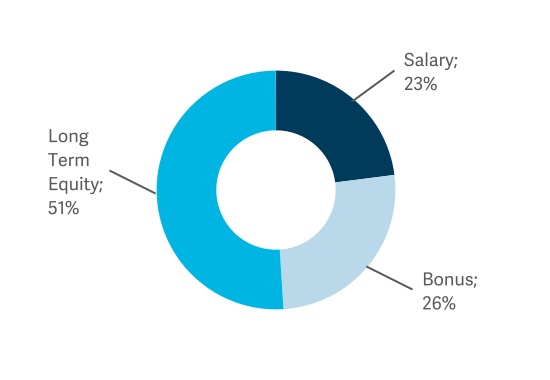

Pay Opportunity Mix. At-risk performance-based compensation represented a significant majority of the 20212023 total direct compensation (TDC) opportunity of our NEOs.NEOs employed at year end.

CEO 2021 Pay Opportunity Mix (% of Target TDC)

At-Risk Performance-Based Pay: 84%

Other NEOs' 2021 Pay Oppty Mix (% of Target TDC)

At-Risk Performance-Based Pay: 77%

Long-Term Equity Incentives. To align our long-term equity awards with the interests of shareholders, 100% of the long-term equity awards granted in March 2021February 2023 to our NEOs are performance-based and cliff vest after three years based on achievement of a three-year cumulative adjusted book value (ABV) per share growth goal. One of our NEOs, Mr. Hughes, retired in 2023 and did not receive a grant during the year.

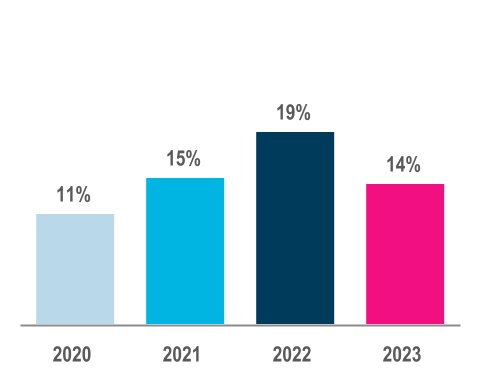

Performance-Based Bonus. Our bonus program is designed to strongly align pay with our performance. Bonus payouts for 20212023 were based on our achievement against three financial performance goals (return on equity new insurance written(ROE), NIW and insurance in force)IIF), and performance against three specific business objectives.

MGIC Investment Corporation – 2024 Proxy Statement │ 7

Best Practices. Our compensation program is grounded in best practices, which include strong stock ownership guidelines for NEOs, no hedging or pledging of our stock, a long-standing “clawback”an updated and rigorous "clawback" policy intended to comply with SEC and stock exchange listing standards, limited change in control benefits (with no tax gross-ups), and very modest perquisites.

MGIC Investment Corporation – 2022 Proxy Statement │ 5

Corporate Governance and Board Matters

The Board of Directors oversees the management of the Company and our business. The Board selects our CEO, and,who in conjunction with our CEO, selects the rest of our senior management team, which is responsible for operating our business.

Corporate Governance Guidelines and

Code of Business Conduct and Ethics

The Board has adopted Corporate Governance Guidelines, which set forth a framework for our governance. The Guidelines cover the Board’s composition, leadership, meeting process, director independence, Board membership criteria, committee structure, succession planning and director compensation. Among other things, the Board meets in executive session outside the presence of any member of our management afterduring at least two Board meetings annually at which directors are present in person and at any additional times determined by the Board or the Lead Director. Mr. Lehman presides at these sessions and has served as the Board’s Lead Director since July 2020. See “ — Board“Board Leadership” for information about the Lead Director’s responsibilities and authority. The Corporate Governance Guidelines provide that a director shall not be nominated by the Board for re‑election if at the date of the Annual Meeting of Shareholders, the director is age 74 or more. The Corporate Governance Guidelines also provide that a director who retires from his or her principal employment or joins a new employer shall offer to resign from the Board. Unless the Board determines that a Chief Executive Officer who is Chairman of the Board should continue as Chairman of the Board after his or her tenure as Chief Executive Officer, a director who is an officer of the Company or a subsidiary and leaves the Company shall resign from the Board. In 2014, the Board determined that Mr. Culver should become non-executive Chairman of the Board upon retirement from his position as Chief Executive Officer in 2015.

The Guidelines also provide specific limitations on other directorships. The Guidelines limit our independent directors from serving as a director of more than three public companies other than the Company. Directors who are officers of the Company or a subsidiary may not serve as a director of more than one public company other than the Company. It is expected that each director will be mindful of other existing and planned future commitments, such that other directorships and commitments do not materially interfere with their service on the Board. Additionally, to avoid overboarding, conflicts of interest and independence issues, a director may not accept a position on the board of directors of another public company without first conferring with the Board Chairperson and Lead Director.

We have a Code of Business Conduct and Ethics emphasizing our commitment to conducting our business in accordance with legal requirements and high ethical standards. The Code applies to all employees, including our executive officers, and specified portions areis also applicable to our directors. Certain portions of the Code that apply to transactions with our executive officers, directors, and their immediate family members are described under “Other Matters – Related“Related Person Transactions” below. These descriptions are subject to the actual terms of the Code.

Our Corporate Governance Guidelines and our Code of Business Conduct and Ethics are available on our website (http://mtg.mgic.com) under the “Leadership & Governance; Documents” links. Written copies of these documents are available to any shareholder who submits a written request to our Secretary. We intend to disclose on our website any waivers from, or amendments to, our Code of Business Conduct and Ethics that are subject to disclosure under applicable rules and regulations.

8 │ MGIC Investment Corporation – 2024Proxy Statement

CORPORATE GOVERNANCE AND BOARD MATTERS

Director Independence

Our Corporate Governance Guidelines regarding director independence provide that a director is not independent if the director has any specified disqualifying relationship with us. The disqualifying relationships are equivalent to those of the independence rules of the New York Stock Exchange (NYSE), except that our disqualification for board interlocks is more stringent than under the NYSE rules. Also, for a director to be independent under the Guidelines, the director may not have any material relationship with us. For purposes of determining whether a disqualifying or material relationship exists, we consider relationships with MGIC Investment Corporation and its consolidated subsidiaries.

The Board has determined that all of our directors except for Mr. Culver, our former CEO, and Mr. Mattke, our current CEO, are independent under the Guidelines and the NYSE rules. The Board made its

6 │ MGIC Investment Corporation – 2022 Proxy Statement

CORPORATE GOVERNANCE AND BOARD MATTERS

independence determinations by considering whether any disqualifying relationships existed during the periods specified under the Guidelines and the NYSE rules. To determine that there were no material relationships, the Board applied categorical standards that it had adopted and incorporated into our Corporate Governance Guidelines. All independent directors met these standards. Under these standards, a director is not independent if payments under transactions between us and a company of which the director is an executive officer or 10% or greater owner exceeded the greater of $1 million or 1% of the other company’s gross revenues. Payments made to and payments made by us are considered separately, and this quantitative threshold is applied to transactions that occurred in each of the three most recent fiscal years of the other company. Also under these standards, a director is not independent if during our last three fiscal years the director:

•was an executive officer or member of a law firm or investment banking firm providing services to us;

•was an executive officer of a charity to which we made contributions; or

•received any direct compensation from us other than as a director, or if during such period a member of the director’s immediate family received compensation from us.

In making its independence determinations, the Board considered payments we made to Moody’s Analytics (of which Dr. Zandi is an executive officer) for research and subscription services for Moody’s Economy.com and related publications, and payments to Moody’s Investors Service for credit rating services. These transactions were below the quantitative threshold contained in our Corporate Governance Guidelines and were entered into in the ordinary course of business by us, Moody’s Analytics and Moody’s Investors Service.

MGIC Investment Corporation – 2024 Proxy Statement │ 9

CORPORATE GOVERNANCE AND BOARD MATTERS

Related Person Transactions

Among other things, our Code of Business Conduct and Ethics prohibits us from entering into transactions in which our “Senior Financial Officers,” executive officers, chief accounting officer, or any their respective immediate family members have a material personal financial interest (either directly or through a company with which the officer has a material relationship) unless all of the following conditions are satisfied:

•the terms of the contract or transaction are fair and equitable, at arm’s length and are not detrimental to our interests;

•the existence and nature of the interests of the officer are fully disclosed to and approved by the Audit Committee; and

•the interested officer has not participated on our behalf in the consideration, negotiation or approval of the contract or transaction.

The Code defines a material interest as one in which our officer or officer's immediate family member is a director or officer of the counterparty to the transaction, or our officer or a member of our officer’s immediate family has a financial interest in such counterparty or any of its affiliates that has a value ofin the aggregate at least 10% of the value of such counterparty.counterparty or the consolidated value of the organization's affiliates. Our Audit Committee does not consider payments and benefits arising in the ordinary course of employment with us, or through services as a director, to be “transactions” subject to its approval.

In addition, the Code requires Audit Committee approval of all transactions with any director or a member of the director’s immediate family, other than transactions involving the provision of goods or services in the ordinary course of business of both parties. The Code contemplates that our non-management directors will disclose all transactions between us and parties related to the director, even if they are in the ordinary course of business.

Under its Charter, the Audit Committee is responsible to conduct a review and oversee all related party transactions for potential conflicts of interest and prohibit such transactions if the Committee determines them to be inconsistent with the interests of the Company. For purposes of the Charter, “related party transaction” means a transaction in which the Company (or its affiliates) is a participant,

MGIC Investment Corporation – 2022 Proxy Statement │ 7

CORPORATE GOVERNANCE AND BOARD MATTERS

the amount exceeds $120,000, and in which one of the following had or will have a direct or indirect material interest: an executive officer, director, or director nominee, or their immediate family members or persons sharing their households, or 5% shareholders.

Insider Trading Policy

Our Insider Trading Policy limits the timing and types of transactions in our securities, as well as transactions in the securities of companies with which the Company does business and competitors of the Company. The Policy applies to all directors and employees of the Company and its subsidiaries, and may be extended to apply to third-party contractors or consultants who have access to non-public information about the Company. Among other restrictions, the policy prohibits directors, NEOs, other officers and certain employees from engaging in short sales of Company securities, entering into hedging transactions referencing the Company’s equity securities, holding Company securities in a margin account, or pledging Company securities as collateral for a loan. All directors and officers (including NEOs), as well as certain other employees with access to material non-public information must also comply with pre-clearance procedures prior to any transaction in Company Securities.

10 │ MGIC Investment Corporation – 2024 Proxy Statement

CORPORATE GOVERNANCE AND BOARD MATTERS

Board Leadership

Mr. Culver serves as non-executive Chairman of the Board and Mr. Lehman serves as Lead Director. Under this structure, the Chairman chairs Board meetings, where the Board discussion includes strategic and business issues. The Board believes that this approach makes sense at this timeis appropriate because Mr. Culver, as ourthe Company's former CEO, is very familiar with our business and strategic plans as reviewed by the Board. Mr. Culver has been with us since 1985,joined the Company in 1982, and served as Chief Executive Officer from 2000 until his retirement in 2015, when he became our non-executive Chairman of the Board.

Because the Board also believes that strong, independent Board leadership is a critical aspect of effective corporate governance, the Board maintains the position of Lead Director. The Lead Director is an independent director selected by the independent directors. The Lead Director’s responsibilities and authority include:

•presiding at all meetings of the Board at which the Chairman is not present;

•having the authority to call and lead executive sessions of directors without the presence of any director who is an officer (or if determined by the Board, a former officer) (the Board meets in executive session afterduring at least two Board meetings each year);

•serving as a conduit between the CEO and the independent directors to the extent requested by the independent directors;

•serving as a conduit for the Board’s informational needs, including proposing topics for Board meeting agendas; and

•being available, if requested by major shareholders, for consultation and communication.

The Board believes that a leader intimately familiar with our business and strategic plans serving as Chairman, together with an experienced and engaged Lead Director, is the most appropriate leadership structure for the Board at this time. The Board periodically reviews the structure of the Board and the Board’s leadership.

Communicating with the Board

Shareholders and other interested persons can communicate with members of the Board, non-management members of the Board as a group or the Lead Director, by sending a written communication to our Secretary, addressed to: MGIC Investment Corporation, Secretary, P.O. Box 488, Milwaukee, WI 53201. The Secretary will pass alongprovide any such communication, other than a solicitation for a product or service, to the Lead Director.

MGIC Investment Corporation – 2024 Proxy Statement │ 11

CORPORATE GOVERNANCE AND BOARD MATTERS

Director Selection

The Board believes that the Board, as a whole, should possess a combination of skills, professional experience, and diversity of backgrounds necessary to oversee our business. In addition, the Board believes there are certain attributes every director should possess, as reflected in the Board’s membership criteria. Accordingly, the Board and the Management Development, Nominating and

8 │ MGIC Investment Corporation – 2022 Proxy Statement

CORPORATE GOVERNANCE AND BOARD MATTERS

Governance Committee (the "MDNG Committee") consider the qualifications of directors and director candidates individually and in the broader context of the Board’s overall composition and our current and future needs.

The Management Development, Nominating and GovernanceMDNG Committee is responsible for developing Board membership criteria and recommending these criteria to the Board. The criteria, which are set forth in our Corporate Governance Guidelines, include an inquiring and independent mind, sound and considered judgment, high standards of ethical conduct and integrity, well-respected experience at senior levels of business, academia, government or other fields, ability to commit sufficient time and attention to Board activities, anticipated tenure on the Board, and whether an individual will enable the Board to continue to have a substantial majority of independent directors. In addition, the Management Development, Nominating and GovernanceMDNG Committee in conjunction with the Board, periodically evaluates the composition of the Board to assess the skills and experience that are currently represented on the Board, as well as the skills and experience that the Board will find valuable in the future. The Management Development, Nominating and GovernanceMDNG Committee seeks a variety of occupational and personal backgrounds on the Board in order to obtain a range of viewpoints and perspectives and enable the Board to have access to a diverse body of talent and expertise relevant to our activities. The MDNG Committee also seeks to enhance the diversity of the Board in other areas, such as geography, age, race, gender and ethnicity. The MDNG Committee’s and the Board’s evaluation of the Board’s composition enables the Board to consider the skills and experience it seeks in the Board as a whole, and in individual directors, as our needs evolve and change over time and to assess the effectiveness of the Board’s efforts at pursuing diversity. In identifying director candidates from time to time, the Management Development, Nominating and GovernanceMDNG Committee may establish specific skills and experience that it believes we should seek in order to constitute a balanced and effective board.

The table below summarizes certain skills and experiences considered important by the Board, how those skills and experiences are relevant to the Company and its business strategies, and how they are represented in the board members standing for election at the Annual Meeting of Shareholders. The MDNG Committee evaluates new director candidates considering these skills and experiences, and the criteria listed above, as well as other factors the MDNG Committee deems relevant, through background reviews, input from other members of the Board and our executive officers, and personal interviews with the candidates attended by at least the MDNG Committee Chair. The MDNG Committee will evaluate any director candidates recommended by shareholders using the same process and criteria that apply to candidates from other sources.

12 │ MGIC Investment Corporation – 20222024 Proxy Statement │ 9

CORPORATE GOVERNANCE AND BOARD MATTERS

| | | | | | | | |

| Skills and Experience | Relevance to MGIC | Board Composition |

| Accounting | We operate in a complex financial and regulatory environment. | |

| Chief Executive Officer | Experience at the highest level of an organization provides expertise that will foster participation in the development and implementation of the Company's business strategies. | |

| Data & Analytics | Experience with the use of structured and unstructured data, as well as the tools and processes necessary to enable the development of actionable insights via advanced quantitative and statistical methods is important as we continue to pursue our strategic initiatives. | |

| Financial | Knowledge of finance or financial reporting and experience with debt and capital markets transactions is important to executing our business strategies. | |

| Housing Markets / Risk Management | A main component of our business involves taking and managing risk associated with the housing markets. | |

| Human Resources | As a financial services firm, human capital represents an important asset. Knowledge of human resources matters is important to executing our business strategies. | |

| Insurance | Insurance industry experience provides understanding of our business and strategies. | |

| Investments | We manage a large and long-term investment portfolio to support our obligations to pay future claims of our policyholders. | |

| Public Co. Executive Experience | As a complex, publicly-held company, practical insight into shareholder concerns and governance matters is important. | |

| Regulatory / Public Affairs | Our business requires compliance with a variety of federal, state and GSE requirements, and involves relationships with various government and non-government organizations. | |

Housing Markets / Risk Management | A main component of our business involves taking and managing risk associated with the housing markets. | |

| Technology / Cyber | We continue to undergo a business process transformation involving upgrades to our technology and to manage our cybersecurity risks. | |

| | |

| Legend: | |

MGIC Investment Corporation – 2024 Proxy Statement │ 13

CORPORATE GOVERNANCE AND BOARD MATTERS

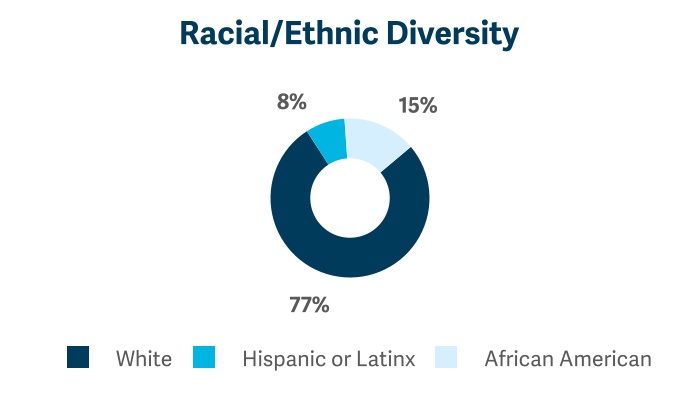

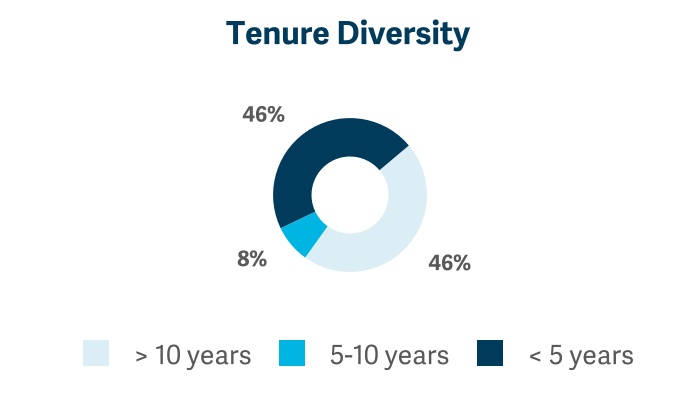

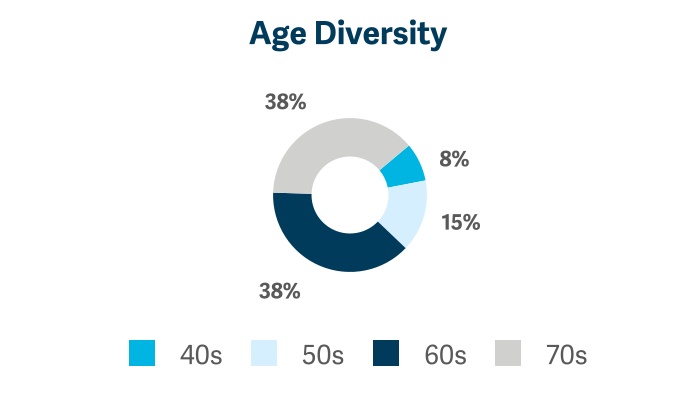

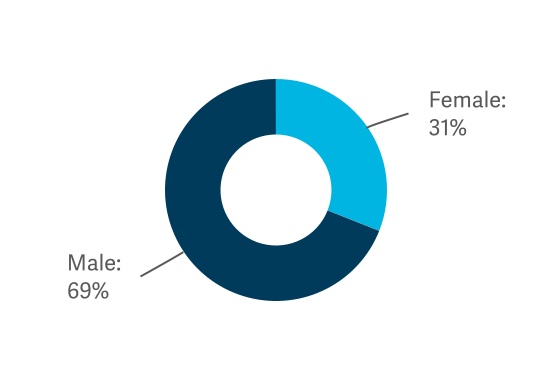

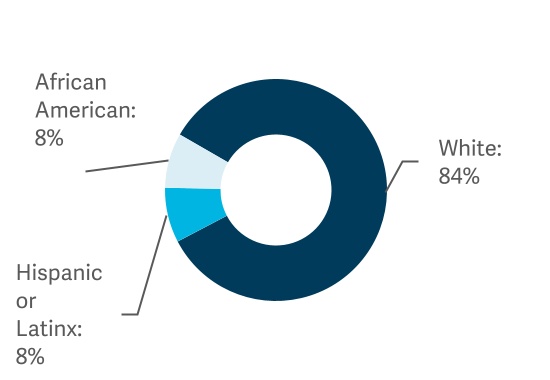

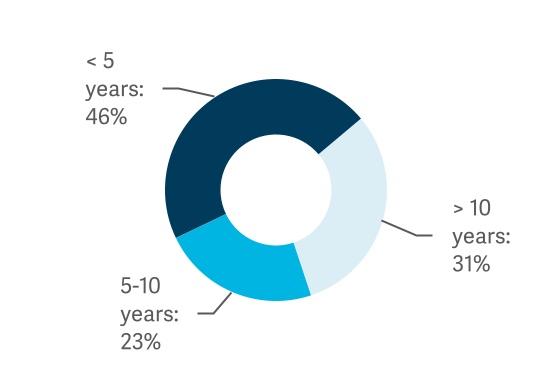

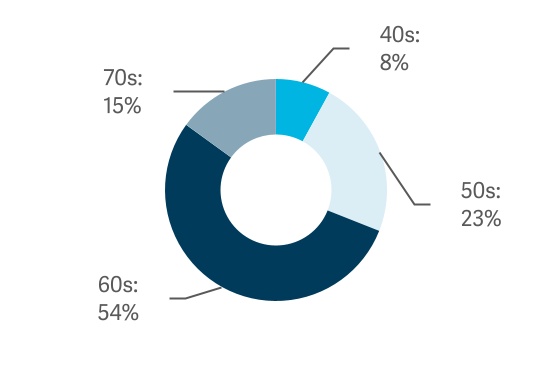

We have continued to refresh and diversify our Board over the last five years as fivesix new independent directors joined our Board, two directors did not stand for re-election due to the age-related retirement policy in our Corporate Governance Guidelines, two directors did not stand for re-election for personal reasons, our new CEO joined the Board and our former CEO retired from the Board. As a result of the changes in our Board composition over the five-year period and the changes proposed to occur at the 2022 Annual Meeting of Shareholders, our Board has increased its gender and racial diversity from 20%33% to 38%46%. The following table and charts reflect the tenure, ages and diversity of the board members standing for election at the Annual Meeting of Shareholders.

| | Board Diversity Matrix (as of March 25, 2022) | Female | Male |

| Board Diversity Matrix (as of March 22, 2024) | | Board Diversity Matrix (as of March 22, 2024) | Female | Male |

| African American or Black | African American or Black | 0 | 1 | African American or Black | 0 | 2 |

| Hispanic or Latinx | Hispanic or Latinx | 1 | 0 | Hispanic or Latinx | 1 | 0 |

| White | White | 3 | 8 | White | 3 | 7 |

| Total | Total | 4 | 9 | Total | 4 | 9 |

10

14 │ MGIC Investment Corporation – 20222024 Proxy Statement

CORPORATE GOVERNANCE AND BOARD MATTERS

Gender Diversity

Racial/Ethnic Diversity

Tenure Diversity

Age Diversity

Oversight of Risk and Environmental, Social and Governance (ESG)Corporate Sustainability Matters

Management

The Company's Senior Leadership Team (SLT) serves as the primary governance body at the management level, and guides and oversees the overall business operations and culture of the company. The SLT is chaired by our Chief Executive Officer. The SLT also oversees reporting by management to the Board of Directors, with the exception of those topics that are attorney-client privileged or that Board or Committee Chairpersons deem to be confidential.

Our senior management is charged with identifying and managing the risks facing our business and operations. The Company's Senior Management Oversight Committee (SMOC) serves as its primary risk management governance organization. The SMOC oversees the Company’s enterprise risk management framework; oversees how the Company aligns its people, processes and technology capabilities with the strategic and business issues critical to the Company; maintains an enterprise view of risk across a set of identified key risks;risks that may exist from time to time; and provides support and reporting to the Board's Risk Management Committee.

The Company's ESGCorporate Sustainability Executive Council supports the Company's on-going initiatives related to environmental, health and safety, corporate social responsibility, corporate governance, sustainability, and other public policy matters relevant to the Company. In performing this general responsibility, the Council has discretion to: assist in settingadopt the Company’s general strategy with respect to ESGcorporate sustainability matters; identify current and emerging ESGcorporate sustainability issues that may affect the Company’s business, strategy, operations,

MGIC Investment Corporation – 2022 Proxy Statement │ 11

CORPORATE GOVERNANCE AND BOARD MATTERS

performance, or public image; make recommendations regarding policies, practices, procedures, or disclosures to address ESGcorporate sustainability matters; implement systems to monitor ESG matters when necessary; oversee the Company’s internal and external reporting and disclosures surrounding ESGcorporate sustainability matters; and advise on stockholdermaterial concerns of shareholders or stakeholder concernsstakeholders regarding ESGcorporate sustainability matters. The ESG Executive Council will make regular reports to the SMOC and to the relevant Committee(s) of the Board of Directors of the Company.

Board of Directors and Committees

The Board of Directors is responsible for oversight of how our senior management addresses risks, including those associated with ESGcorporate sustainability matters, to the extent they are material. In this regard, the Board seeks to understand the material risks we face and to allocate, among the full Board and its committees, responsibilities for overseeing how management addresses the risks, including the risk management systems and processes that management uses for this purpose. Overseeing risk is an ongoing process. Accordingly, the Board periodically considers risk throughout the year and also with respect to specific proposed actions. Each of the Board's committees (other than the Executive Committee) meet regularly, play significant roles in carrying out the risk and ESGcorporate sustainability oversight functions, and report back to the full Board. Each of their roles in the oversight of the Company's risk is described below under "Board Meetings and Committees."

We believe that our leadership structure, discussed in “Board Leadership” above, supports the risk oversight function of the Board. Our former CEO serves as Chairman of the Board and has a wealth of experience with the risks of our Company and industry. Our current CEO is a director who keeps the Board informed about the risks we face. In addition, independent directors chair the various committees involved with risk oversight and there is open communication between senior management and directors.

MGIC Investment Corporation – 2024 Proxy Statement │ 15

Board Meetings and Committees

The Board of Directors held sixfive meetings during 2021.2023. Each director standing for re-electionelected at our 20222023 Annual Meeting of Shareholders attended at least 75% of the meetings of the Board and committees of the Board on which he or she served. The Annual Meeting of Shareholders is scheduled in conjunction with a Board meeting and, as a result, directors are expected to attend the Annual Meeting. All of our directors serving on the Board at that time attended the 2021The 2023 Annual Meeting of Shareholders.Shareholders was attended by each of the directors who stood for election at the Meeting.

The Board has six standing committees: Audit; Business Transformation and Technology; Management Development, Nominating and Governance; Risk Management; Securities Investment; and Executive. Information regarding these committees is provided below. With the exception of the Executive Committee, each committee consists entirely of independent directors and the charters for those committees are available on our website (http://mtg.mgic.com) under the “Leadership & Governance; Documents” links. Written copies of these charters are available to any shareholder who submits a written request to our Secretary. The functions of the Executive Committee are established under our Bylaws and are described below.

GivenCurrent committee membership and the critical naturenumber of 2023 committee meetings are set forth below.1

| | | | | | | | | | | | | | | | | | | | |

| Audit | Business Transformation

& Technology | Executive | Management Development, Nominating and Governance | Risk Management | Securities Investment |

| Analisa M. Allen | | l | | | l | |

| Daniel A. Arrigoni | | | | l | l | |

| C. Edward Chaplin | C | | | | | l |

| Curt S. Culver | | | l | | | |

| Jay C. Hartzell | l | | | | l | |

| Timothy A. Holt | | | | l | | C |

| Jodeen A. Kozlak | | C | | l | | |

| Michael E. Lehman | | l | l | C | | |

| Teresita M. Lowman | l | l | | | | |

| Timothy J. Mattke | | | C | | | |

| Sheryl L. Sculley | l | | | | | l |

| Michael L. Thompson | | | | | l | |

| Mark M. Zandi | | | | | C | l |

| 2023 Meetings | 9 | 5 | 0 | 4 | 4 | 4 |

| C = Chairman | | | | | | |

1 Gary Poliner did not stand for re-election at the 2023 Annual Meeting of Shareholders. Mr. Poliner's decision was not due to any disagreement on any matter relating to the Company's operations, policies or practices. Mr. Poliner served as Audit Committee Chairperson until February 5, 2023, and thereafter was a member of the risks and opportunitiesAudit Committee until the expiration of his term in technology and business process transformation, and the size of the investments in this area, the Board decided that more focused oversight would be appropriate and it created the Business Transformation and Technology Committee in early 2022 to oversee those important issues.April 2023.

12 │

MGIC Investment Corporation – 20222020 Proxy Statement │ 16

CORPORATE GOVERNANCE AND BOARD MATTERS

Current committee membership and the number of 2021 committee meetings are set forth below.

| | | | | | | | | | | | | | | | | | | | |

| Audit | Business Transformation

& Technology | Executive | Management Development, Nominating and Governance | Risk Management | Securities Investment |

| Analisa M. Allen | | l | | | l | |

| Daniel A. Arrigoni | l | | | | l | |

| C. Edward Chaplin | | | | | l | l |

| Curt S. Culver | | | l | | | |

| Jay C. Hartzell | l | | | | l | |

| Timothy A. Holt | | | | l | | C |

| Jodeen A. Kozlak | | C | | l | | |

| Michael E. Lehman | | l | l | C | | |

Melissa B. Lora 1 | l | | | l | | |

Teresita M. Lowman 2 | | Proposed | | | | |

| Timothy J. Mattke | | | C | | | |

| Gary A. Poliner | C | | | | l | l |

| Sheryl L. Sculley | l | | | | | l |

| Mark M. Zandi | | | | | C | |

| 2021 Meetings | 14 | New in 2022 | 0 | 6 | 4 | 7 |

| C = Chairman | | | | | | |

| 1 Ms. Lora is not standing for re-election at the 2022 Annual Meeting of Shareholders. |

| 2 Ms. Lowman has been nominated to join the Board of Directors at the 2022 Annual Meeting of Shareholders. |

Audit Committee

Key responsibilitiesResponsibilities:

•Oversee the integrity of our financial statements

•Oversee the effectiveness of our system of internal controls over accounting and financial reporting, and disclosure controls and procedures

•Appoint, retain and oversee the independent registered public accountant, and evaluate its qualifications, independence and performance

•Oversee the performance of our internal audit function

•Oversee our compliance with legal and regulatory requirements

•Review related party transactions, as further described above under "Related Person Transactions."

Risk Oversight Role:

•Oversee our processes for assessing risks (other than risks overseen by other committees) and the effectiveness of our system of internal controls. Meet with the Chief Risk Officer and the Chairman of the Risk Management Committee to discuss and review in a general manner the Risk Management Committee's oversight of the Company's enterprise risk management framework

MGIC Investment Corporation – 2022 Proxy Statement │ 13

CORPORATE GOVERNANCE AND BOARD MATTERS

•Oversee process, fraud, compliance and reserving risks

All members of the Audit Committee meet the heightened independence criteria that apply to Audit Committee members under SEC and NYSE rules. The Board has determined that Mr. Chaplin, Dr. Hartzell and Mses. LoraLowman and Sculley are “audit committee financial experts” as defined in SEC rules.

Business Transformation and Technology Committee

Key responsibilitiesResponsibilities:

•Oversee the Company's information technology strategy, including reviewing its strategy and initiatives, the strategy for developing and maintaining market-competitive information technology capabilities, and major information technology trends that pose risks or opportunities for the Company

•Oversee how information technology supports the Company's business strategies

•Oversee major business transformation projects

Risk Oversight Role:

•Oversee risks associated with the Company's technology capabilities

•Oversee cybersecurity (including data security) and business continuity risks

Management Development, Nominating and Governance Committee

Key responsibilitiesResponsibilities:

•Oversee our executive compensation program, including approving corporate goals relating to compensation for our CEO, determining our CEO’s annual compensation, approving compensation for our other senior executives and making recommendations to the Board regarding incentive compensation plans and equity-based plans for the CEO and senior management

•Evaluate the annual performance of the CEO and oversee the CEO succession planning process

MGIC Investment Corporation – 2024 Proxy Statement │ 17

CORPORATE GOVERNANCE AND BOARD MATTERS

•Make recommendations to the Board regarding the compensation of directors

•Review our Corporate Governance Guidelines and oversee the Board’s self-evaluation and director orientation processes

•Identify new director candidates through recommendations from Committee members, other Board members and our executive officers; consider candidates recommended by shareholders (see “What are the deadlines for submission of shareholder proposals, or for nominating or recommending a director candidate for nomination, for the next Annual Meeting?” below); and make recommendations to the Board to fill open director and committee member positions

Risk Oversight Role:

•Oversee corporate governance matters

•Oversee operational risks related to human capital, which include risks associated with human capital management policies such as executive compensation; succession planning; management recruitment, retention, training and development; workforce planning, recruitment, morale and talent; diversity and inclusion strategies and initiatives; and work environment, including health and safety

All members of the Management Development, Nominating and GovernanceMDNG Committee meet the heightened independence criteria that apply to compensation committee members under the rules of the SEC and NYSE.

14 │ MGIC Investment Corporation – 2022 Proxy Statement

CORPORATE GOVERNANCE AND BOARD MATTERS

Risk Management Committee

Key responsibilitiesResponsibilities:

•Oversee the administration of our enterprise risk management framework, including:

◦The capabilities of, and the resources allocated to, enterprise risk management

◦The methodologies, policies, systems and processes established by management to identify, assess, measure, monitor, mitigate, limit, report on, and establish risk profiles for, the key risks that are inherent in our business activities and strategies

◦The enterprise-wide assessment of key current and potential future risks regularly conducted by management

◦Coordinate with the Board and other Board Committees to assign oversight responsibilities for all identified key risks to the Board and other Committees

◦Review significant regulatory reports or disclosures required by law relating to the risk management program of the Company

Risk Oversight Role:

•Oversee the Company's enterprise risk management framework, including the Company's view of risk on an enterprise-wide basis

•Oversee the following key Company risks: pricing, underwriting, mortgage credit, climate change, model, compliance with the non-financial Private Mortgage Insurer Eligibility Requirements of Fannie Mae and Freddie Mac (for which the Audit Committee is responsible), and reinsurer counterparty risks

18 │ MGIC Investment Corporation – 2024 Proxy Statement

CORPORATE GOVERNANCE AND BOARD MATTERS

Securities Investment Committee

Key responsibilitiesResponsibilities:

•Oversee management of our investment portfolio and the investment portfolios of the Company’s employee benefit plans by those persons (employees of the Company or external asset managers) who are managing such assets on a day-to-day basis

•Make recommendations to the Board with respect to our retirement benefit plans that are available to employees generally

•Capital management (other than external reinsurance), including repurchase of common stock and debt, and external funding

Risk Oversight Role:

•Oversee risks related to our investment portfolio and capital management, which include market risk; investment portfolio counterparty risk; capital risk related to our capital structure, access to capital and credit rating; and liquidity risk

•Oversight of risks related to our investment portfolio may include consideration of ESGCSR factors

Executive Committee

The Executive Committee provides an alternative to convening a meeting of the entire Board should a matter arise between Board meetings that requires Board authorization. The Executive Committee is established under our Bylaws and has all authority that the Board may exercise with the exception of certain matters that under the Wisconsin Business Corporation Law are reserved to the Board itself.

MGIC Investment Corporation – 20222024 Proxy Statement │ 1519

Nominees for Director

For Term Ending at the Annual Meeting in 20232025

WithTwelve of the exception of Ms. Lowman, each nomineethirteen nominees listed below is a director of the Company who was previously elected by the shareholders. Ms. LowmanThe only director not previously elected by shareholders is Michael L. Thompson, who was introduced to the Board by an independent director and was nominatedappointed by the Board to stand for election at the 2022 Annual Meetingin October of Shareholders.2023. In evaluating directors for (re)nomination to the Board, the Management Development, Nominating and GovernanceMDNG Committee considered a variety of factors. These included the Board membership criteria described under “Director Selection” above and past performance on the Board based on any feedback from other Board members.

Information about our director nominees appears below. The biographical information is as of March 11, 2022,22, 2024 and for each director includes a discussion about the skills and qualifications that the Board views as supporting the director’s continued service on the Board.

| | | | | | | | | | | |

| | | |

| Analisa M. Allen Director Since: 2020 Age: 6265 | Committees: •Business Transformation & Technology •Risk Management | |

Analisa M. Allen is an information technology consultant with the Gerson Lehrman Group. She is the former Chief Information Officer of Data & Analytics (2017-2019) and the former Chief Information Officer for Home Lending Technology (2015-2017), in each case for the consumer bank at JP Morgan Chase & Co. Ms. Allen has also held several leadership positions with Goldman Sachs & Co., a firm she served for a total of 24 years, where she was responsible for business planning and technical strategy, including as Managing Director, Co-Head of Global Operations Technology (2008-2015) and Managing Director, Global Regulatory, Risk and Control Head (2006-2013).

Ms. Allen brings to the Board extensive information technology and leadership experience, including in highly regulated industries. |

| | | | | | | | | | | |

| | | |

| | | |

| Daniel A. Arrigoni Director Since: 2013 Age: 7173 | Committees: •AuditManagement Development, Nominating and Governance •Risk Management | |

Daniel A. Arrigoni was President and Chief Executive Officer of U.S. Bank Home Mortgage Corp., one of the largest originators and servicers of home loans in the U.S., until his retirement in 2013. Prior to his retirement, Mr. Arrigoni also served as an Executive Vice President of U.S. Bank, N.A. Mr. Arrigoni led the mortgage company for U.S. Bank and its predecessor companies since 1996. Mr. Arrigoni has over 40 years of experience in the residential mortgage and banking industries.

Mr. Arrigoni brings to the Board a broad understanding of the mortgage business and its regulatory environment, skill in assessing and managing credit risk, and significant finance experience, each gained from his many years of executive management in the residential mortgage and banking industries. |

| | | |

1620 │ MGIC Investment Corporation – 20222024 Proxy Statement

| | | | | | | | | | | |

| | | |

| C. Edward Chaplin Director Since: 2014 Age: 6567 | Committees: •Risk ManagementAudit (Chair) •Securities Investment | Public Directorships: •Brighthouse Financial, Inc. |

C. Edward Chaplin was President and Chief Financial Officer at MBIA Inc., a provider of financial guarantee insurance and the largest municipal bond-only insurer, from 2008 until 2016, and remained with MBIA as Executive Vice President until his January 1, 2017 retirement. He joined MBIA in 2006 as its Chief Financial Officer, after having served as a member of its Board of Directors from 2003 until 2006. Prior to joining MBIA, Mr. Chaplin was Senior Vice President and Treasurer of Prudential Financial Inc., a firm he joined in 1983 and for which he held various senior management positions, including Regional Vice President of Prudential Mortgage Capital Company.

Mr. Chaplin brings to the Board a deep understanding of the insurance and real estate industries, management and leadership skills, and financial expertise. |

| | | | | | | | | | | |

| | | |

| | | |

| Curt S. Culver Chairman of the Board Director Since: 1999 Age: 6971 | Committees: •Executive | Public Directorships: •WEC Energy Group, Inc. and its subsidiary Wisconsin Electric Power Company |

Curt S. Culver is the Board's Chairman. Mr. Culver’s career spans more than 40 years in the private mortgage insurance industry, including 33 years at MGIC. Mr. Culver joined MGIC in 1982, was ournamed President and Chief Operating Officer in 1996, and on January 1, 2000 became Chief Executive Officer of MGIC Investment Corporation. He added the title of Chairman of the Board from 2005 untilin 2006. Upon his retirement as our Chief Executive Officer in 2015. He has served as our non-executive Chairman of the Board since 2015. He was our Chief Executive Officer from 2000 and was the Chief Executive Officer of Mortgage Guaranty Insurance Corporation (MGIC) from 1999, in both cases until his retirement, and he held senior executive positions with us and MGIC for more than five years before2015, he became Chief Executive Officer.

Non-Executive Chairman.

Mr. Culver brings to the Board extensive knowledge of our business and operations and a long-term perspective on our strategy. |

| | | | | | | | | | | |

| | | |

| | | |

| Jay C. Hartzell Director Since: 2019 Age: 5254 | Committees: •Audit •Risk Management | |

Jay C. Hartzell is President of the University of Texas at Austin. Prior to being named President of the University in 2020, he was Dean of its McCombs School of Business, a position he held since 2016. He joined the University of Texas in 2001 and held several key administrative roles at the McCombs School before being named Dean, including Senior Associate Dean for Academic Affairs, Chair of the Finance Department, and Executive Director of the School’s Real Estate Finance and Investment Center. Prior to joining the University of Texas, Dr. Hartzell taught at the Stern School of Business at New York University.

As a senior university administrator and an experienced academic, Dr. Hartzell provides our Board with expertise on business organization, governance, real estate finance and corporate finance matters. |

| | | |

MGIC Investment Corporation – 20222024 Proxy Statement │ 1721

| | | | | | | | | | | |

| | | |

| Timothy A. Holt Director Since: 2012 Age: 6871 | Committees: •Management Development, Nominating & Governance •Securities Investment (Chair) | Public Directorships: •Virtus Investment Partners, Inc.

|

Timothy A. Holt was an executive committee member and Senior Vice President and Chief Investment Officer of Aetna, Inc., a diversified health care benefits company, when he retired in 2008 after 30 years of service. From 2004 through 2007, he also served as Chief Enterprise Risk Officer of Aetna. Prior to being named Chief Investment Officer in 1997, Mr. Holt held various senior management positions with Aetna, including Chief Financial Officer of Aetna Retirement Services and Vice President, Finance and Treasurer of Aetna.

Mr. Holt brings to the Board investment expertise, skill in assessing and managing investment and credit risk, broad-based experience in a number of areas relevant to our business, including insurance, and senior executive experience gained at a major public insurance company. |

| | | | | | | | | | | |

| |

|

| | |

| Jodeen A. Kozlak Director Since: 2018 Age: 5860 | Committees: •Business Transformation & Technology (Chair) •Management Development, Nominating & Governance | Public Directorships: •C.H. Robinson Worldwide, Inc. •KB Home •Leslie's Inc.

|

Jodeen A. Kozlak is the founder of Kozlak Capital Partners, LLC, a private consulting firm, and has served as its CEO since 2017. Ms. Kozlak previously served as the Global Senior Vice President of Human Resources of Alibaba Group, a multinational conglomerate (2016-2017). Ms. Kozlak also previously served as the Executive Vice President and Chief Human Resources Officer of Target Corporation, one of the largest retailers in the U.S. (2007-2016), and held other senior leadership roles in her 15-year career there. Prior to joining Target, Ms. Kozlak was a partner in a private law practice.

Ms. Kozlak brings to the Board significant executive management experience. Through her service as Executive Vice President and Chief Human Resources Officer at a Fortune 100 company, Ms. Kozlak has developed significant knowledge and expertise in the area of human capital development and a deep understanding of executive compensation and business transformation within a public company. |

| | | | | | | | | | | |

| |

| | | |

| Michael E. Lehman Lead Independent Director Director Since: 2001 Age: 7173 | Committees: •Business Transformation & Technology •Executive •Management Development, Nominating and Governance (Chair) | Public Directorships: •Astra Space, Inc.

|

Michael E. Lehman served the University of Wisconsin in various capacities from March 2016 until October 2021, including as Interim Chief Operating Officer of the Wisconsin School of Business, Special Advisor to the Chancellor, Interim Vice Provost for Information Technology, Chief Information Officer and Interim Vice Chancellor for Finance and Administration. He had previously been a consultant (2014-2016); Interim Chief Financial Officer at Ciber Inc., a global information technology company (2013-2014); Chief Financial Officer of Arista Networks, a cloud networking firm (2012-2013); and Chief Financial Officer of Palo Alto Networks, a network security firm (2010-2012). Earlier in his career, he was the Executive Vice President and Chief Financial Officer of Sun Microsystems, Inc., a provider of computer systems and professional support services.

Mr. Lehman brings to the Board financial and accounting knowledge gained through his service as chief financial officer of a large, multinational public company; skills in addressing the range of financial issues facing a large company with complex operations; senior executive and operational experience; as well as technology and cybersecurity experience. |

| | | |

1822 │ MGIC Investment Corporation – 20222024 Proxy Statement

| | | | | | | | | | | |

| | | |

| Teresita M. Lowman Director Since: N/A2022 Age: 5759 | Proposed Committees: •Audit •Business Transformation & Technology

| Public Directorships:

•One Stop Systems, Inc.

|

Teresita (Sita) M. Lowman is a Strategic Advisor to Launch Factory, an incubator of technology start-up companies, a role she assumed in April 2021. She previously served at DXC Technology Company, a multi-billion-dollar Fortune 500 information technology services company, from 2017 until October 2021, most recently as the Vice President and General Manager of its America’s Microsoft Dynamics Portfolio, and in other leadership roles before then.prior to that as the global SAP platform services leader. She earlier served in leadership roles at Hewlett Packard Enterprise, Nortel Networks and Texas Instruments Defense Group (acquired by Raytheon). Ms. Lowman brings to the Board significant leadership experience in the information technology, business transformation, and cloud enterprise risk across a range of industries. Her technical expertise includes businessdigital transformation, cyber security, SaaS, cloud computing, data analytics, risk management and business continuity. |

| | | | | | | | | | | |

| | | |

| Timothy J. Mattke Director Since: 2019 Age: 4648 | Committees: •Executive (Chair) | |

Timothy J. Mattke has been our Chief Executive Officer since 2019. He served as our Executive Vice President and Chief Financial Officer from 2014 to 2019, and our Controller from 2009 to 2014. Before then, he held other positions within the Accounting and Finance Departments. Before joining the Company in 2006, Mr. Mattke had been with PricewaterhouseCoopers LLP.

Mr. Mattke brings to the Board extensive knowledge of our industry, business and operations; financial acumen; a long-term perspective on our strategy; and the ability to lead our Company as the mortgage finance system and the mortgage insurance industry evolve. |

| | | | | | | | | | | |

|

|

| | | |

| Gary A. Poliner

Director Since: 2013

Age: 68

| Committees:

•Audit (Chair)

•Risk Management

•Securities Investment

| Public Directorships:

•Independent Trustee of the Janus Henderson Funds (58 funds)

|

Gary A. Poliner was President of The Northwestern Mutual Life Insurance Company (Northwestern Mutual), the nation’s largest direct provider of individual life insurance, and a member of its Board of Trustees, until his retirement from that company in June 2013, after more than 35 years of service. He was named President of Northwestern Mutual in 2010. Mr. Poliner also held various other senior-level positions at Northwestern Mutual, including Chief Financial Officer (2001-2008) and Chief Risk Officer (2009-2012).

Mr. Poliner brings to the Board a breadth of executive management experience in the insurance industry, including risk management, and financial and insurance regulatory expertise. |

| | | |

| | | |

| Sheryl L. Sculley Director Since: 2019 Age: 6971 | Committees: •Audit •Securities Investment | |

Sheryl L. Sculley is the former City Manager of the City of San Antonio Texas, the Chief Executive Officer of the municipal corporation, a position she held from 2005 until her retirement in April 2019. Prior to serving in that role, Ms. Sculley had been the Assistant City Manager (Chief Operating Officer) of Phoenix, Arizona from 1989 until 2005, the City Manager (Chief Executive Officer) of Kalamazoo, Michigan from 1984 until 1989 and in other city management roles before then. Today she is a consultant with Strategic Partnerships, Inc., and an adjunct professor at the University of Texas LBJ School of Public Affairs.

Ms. Sculley’s experience as a Chief Executive Officer leading large municipalities provides our Board with expertise on management, investment, financial and human resources matters. |

| | | |

MGIC Investment Corporation – 20222024 Proxy Statement │ 1923

| | | | | | | | | | | |

| | | |

| Mark M. ZandiMichael L. Thompson

Director Since: 20102023 Age:6268 | Committees: •Risk Management | |

Michael L. Thompson is the President and Chief Executive Officer of Fair Oaks Foods, a food manufacturing company of high-quality meats and non-meat proteins, a role he has held since 2003. Prior to Fair Oaks Foods, Mr. Thompson spent nearly 20 years at McDonald’s Corporation where he served in leadership roles including Vice President of North American Supply Chain Management (1985-2003).

Mr. Thompson brings to the Board executive management and operational expertise gained through his experience as a Chief Executive Officer and as an executive at a large multinational public company. In addition, Mr. Thompson possesses broad-based skills in a number of areas relevant to our business including financial reporting and transactions, the insurance industry, and regulatory compliance. |

| | | | | | | | | | | |

| | | |

| Mark M. Zandi Director Since: 2010 Age: 64 | Committees: •Risk Management (Chair) •Securities Investment | |

Mark M. Zandi since 2007, has been Chief Economist of Moody’s Analytics, Inc., since 2007, where he directs economic research.research and consulting. Moody’s Analytics is a leading provider of economic research, data, and analytical tools. It is a subsidiary of Moody’s Corporation that is separately managed from Moody’s Investors Service, the rating agency subsidiary of Moody’s Corporation. Dr. Zandi is a trusted adviser to policymakers and an influential source of economic analysis for businesses, journalists and the public, and he frequently testifies before Congress on economic matters.

Dr. Zandi, with his economics and residential real estate industry expertise, brings to the Board a deep understanding of the economic factors that shape our industry. In addition, Dr. Zandi has expertise in the legislative and regulatory processes relevant to our business. |

| | | |

24 │ MGIC Investment Corporation – 2024 Proxy Statement

Item 1 – Election of Directors

Item 1 consists of the election of directors. The Board, upon the recommendation of the Management Development, Nominating and GovernanceMDNG Committee, has nominated Analisa M. Allen, Daniel A. Arrigoni, C. Edward Chaplin, Curt S. Culver, Jay C. Hartzell, Timothy A. Holt, Jodeen A. Kozlak, Michael E. Lehman, Teresita M. Lowman, Timothy J. Mattke, Gary A. Poliner, Sheryl L. Sculley, Michael L. Thompson, and Mark M. Zandi for election or re-election as applicable, to the Board to serve until our 20232025 Annual Meeting of Shareholders. If any nominee is not available for election, proxies will be voted for another person nominated by the Board or the size of the Board will be reduced.

Shareholder Vote Required